Transforming Workers Compensation Underwriting

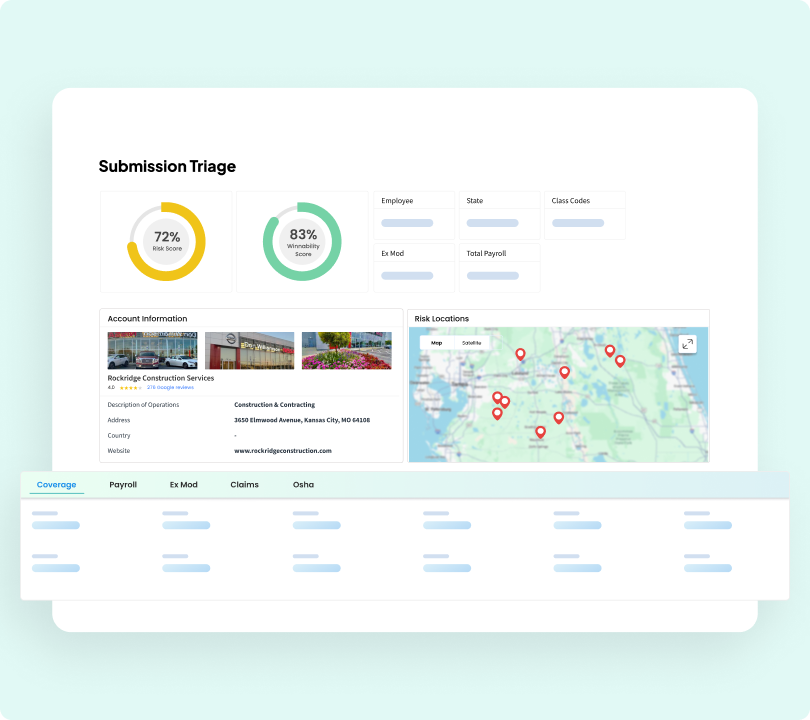

360-degree Workers Compensation Risk

Aggregate data from ACORD 130, payroll schedule, ex-mod reports and loss runs – further enriched with external sources such as OSHA records and regulatory databases.

360-degree Workers Compensation Risk

Aggregate data from ACORD 130, payroll schedule, ex-mod reports and loss runs – further enriched with external sources such as OSHA records and regulatory databases.

Operational Scalability

Enables underwriters to manage growing submission volumes and complex accounts without additional staffing, even during rate filings or regulatory change periods.

Operational Scalability

Enables underwriters to manage growing submission volumes and complex accounts without additional staffing, even during rate filings or regulatory change periods.

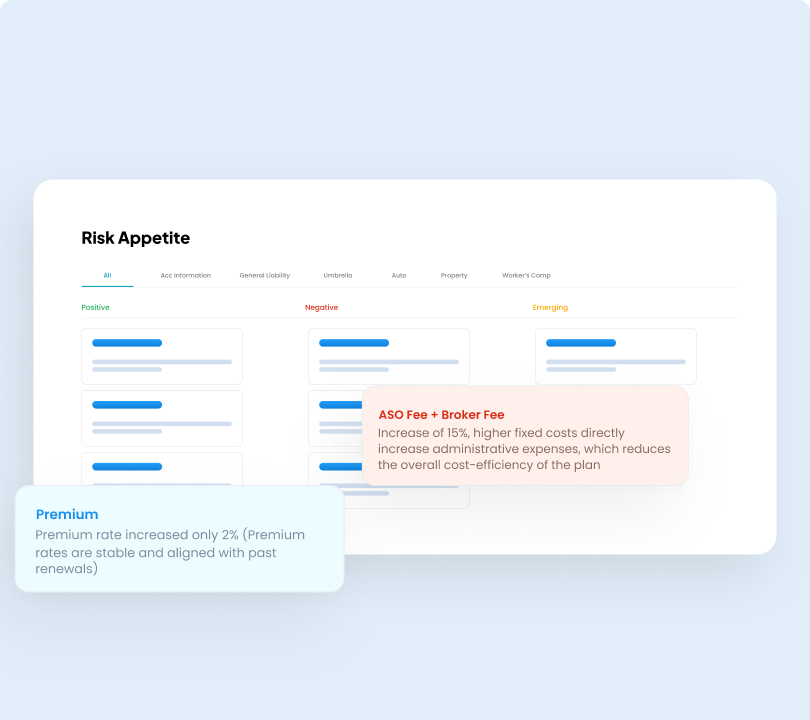

Smarter Risk Decisions

Data-driven decision tools increase accuracy and profitability in workers compensation pricing and risk selection.

Smarter Risk Decisions

Data-driven decision tools increase accuracy and profitability in workers compensation pricing and risk selection.

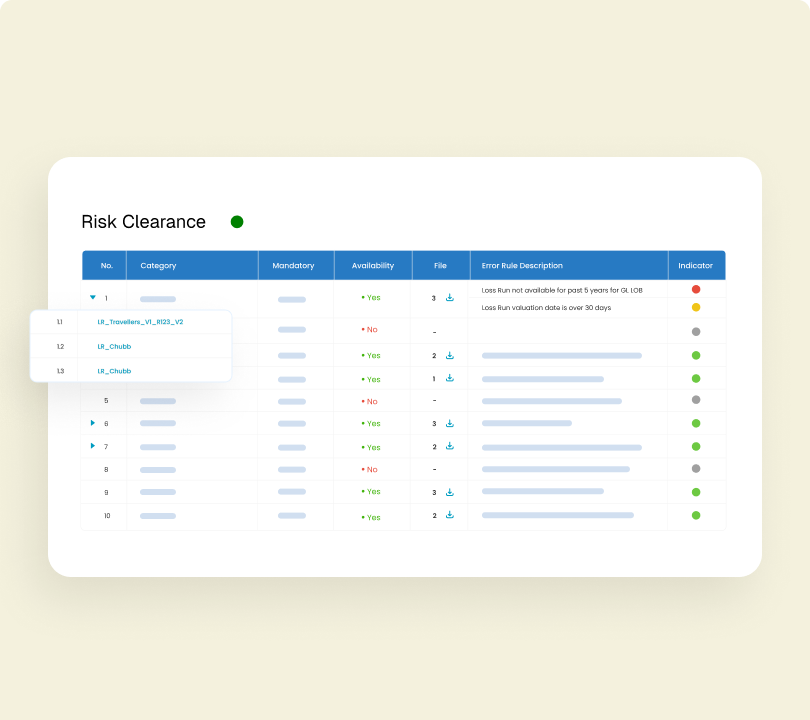

Regulatory Confidence

Incorporate state-specific workers comp rules and required documentation checks, reducing exposure to compliance issues and streamlining audits.

Regulatory Confidence

Incorporate state-specific workers comp rules and required documentation checks, reducing exposure to compliance issues and streamlining audits.

AI-powered tools to evaluate claims history, Ex-Mod and OSHA compliance, enabling precise risk assessment. Streamline underwriting with real-time insights for faster, more accurate policy decisions.

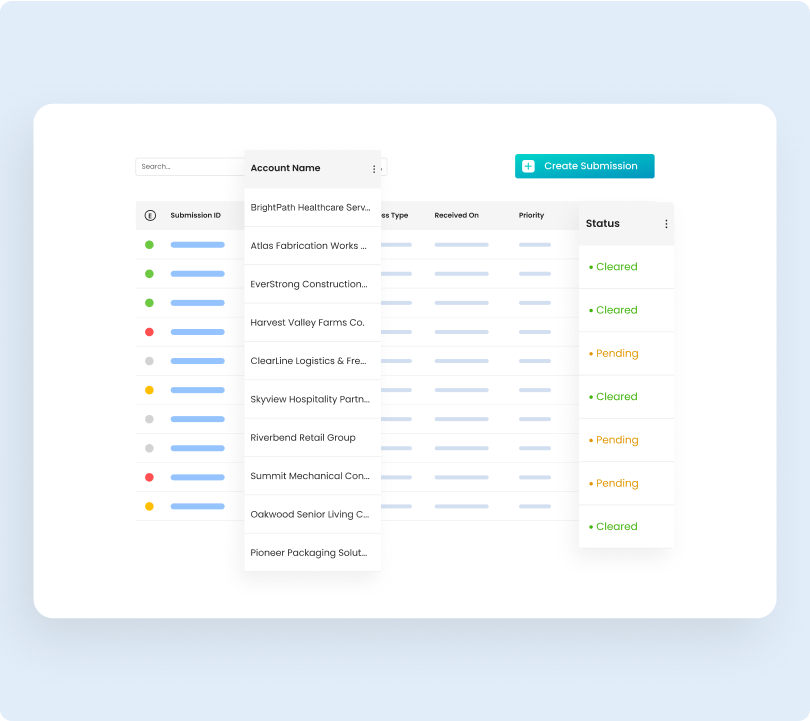

Centralized Inbox & Communication Hub

Purpose‑built for WC submission intake, collaboration, and auditability.

- Unified inbox for emails, documents, notes; automated tasks and SLA tracking.

- Complete audit trail for communications, file versions, and underwriting decisions.

- WC intake supports ACORD 130, payroll schedules, loss runs, SOV, Ex-Mods, OSHA.

- Links to OSHA feeds and bureau Ex-Mod retrieval/validation across all states.

Prioritized Submission Triage

Smart routing and prioritization to focus on winnable WC deals.

- Automated WC scoring with winnability indicators, color-coded statuses, and SLA tracking.

- Configurable rules align with appetite, business goals, and underwriting objectives.

- Document-aware triage prioritizes ACORD 130, recent loss runs, payroll, Ex-Mods.

- Third-party enrichment: NAICS mapping, prohibited class detection, bureau Ex-Mod lookups and OSHA logs.

Regulatory Compliance Automation

Real‑time checks ensure accurate and complete WC submissions before underwriting.

- Required WC docs vary by state; includes ACORD, payroll, loss runs, OSHA.

- Validates valuation freshness, mod effective dates, and cross-document payroll/headcount/location reconciliations.

- Flags missing/invalid class codes, maps NAICS, verifies signatures, officer forms.

- Automates OSHA retrieval, connects to bureaus for Ex-Mod validation and audit links.

Automated Risk Appetite Check

Clear appetite fit assessments tailored for Workers’ Compensation.

- Appetite matrices by class code families with state-specific experience mod thresholds.

- Supports bureau/jurisdiction nuances, out-of-state limits, and subcontractor underwriting rules.

- Benchmarks against peer cohorts, historical performance, and verified bureau Ex-Mod values.

- Integrates OSHA severity/recency data and prohibited class rules into appetite scoring.

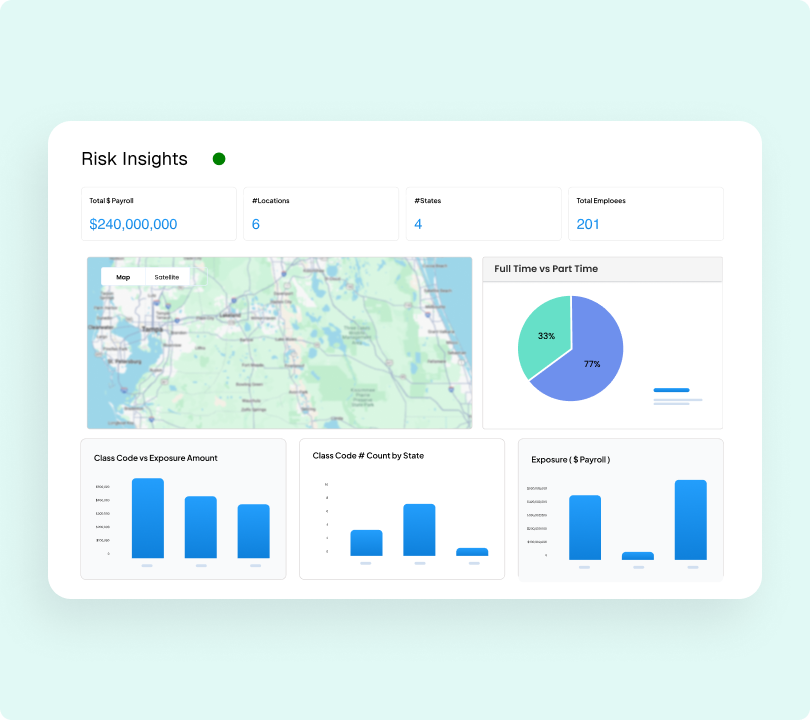

Risk Insights for WC

Operational and actuarial analytics designed for WC underwriting.

- Tracks loss trends, claim lag, development, closure rates, and jurisdictional differences.

- Analyzes payroll volatility, class code shifts, and projects prospective Ex-Mod scenarios.

- Combines completeness, OSHA signals, and loss analytics into underwriting readiness scoring.

- Benchmarks Ex-Mod trajectory by bureau, overlaying OSHA citations, and enforcement actions.