Why Brokers & Carriers Trust Us

Automated Document Intelligence

Transform data from complex submission documents such as Application forms, CAB report, IFTA reports, Loss runs and MVR, into consumable insights.

Automated Document Intelligence

Transform data from complex submission documents such as Application forms, CAB report, IFTA reports, Loss runs and MVR, into consumable insights.

Single View of Trucking Risk

Gain a comprehensive and unified 2000+ data points on trucking insurance risk by aggregating data from documents and external sources.

Single View of Trucking Risk

Gain a comprehensive and unified 2000+ data points on trucking insurance risk by aggregating data from documents and external sources.

Accelerated Submission Flow

Drastically reduce time needed to process and validate trucking insurance submissions from weeks to a few hours.

Accelerated Submission Flow

Drastically reduce time needed to process and validate trucking insurance submissions from weeks to a few hours.

Integrated Placement Workflow

Pre-built integration and workflows for a single-window ordering of reports such as MVR and Loss Runs.

Integrated Placement Workflow

Pre-built integration and workflows for a single-window ordering of reports such as MVR and Loss Runs.

Reimagining trucking insurance with intelligent automation - seamlessly validating risk, matching the right markets, and accelerating quotes with confidence.

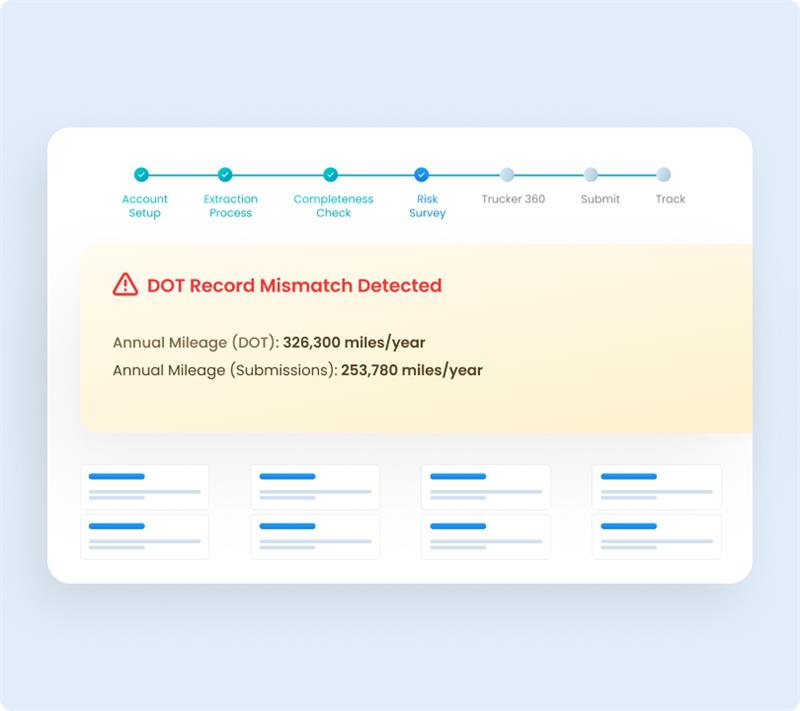

DOT & FMCSA Data Validation

Instantly match submitted data with official DOT and FMCSA records for accuracy

- Highlight high OOS (Out of Service) rates, recent serious violations.

- Highlight worsening or improving safety metrics.

- Auto-alert underwriters when an entity's DOT status changes (e.g., revoked, deactivated).

- Flags missing forms, attachments instantly.

- Applies business rules to surface inconsistencies across submitted documents.

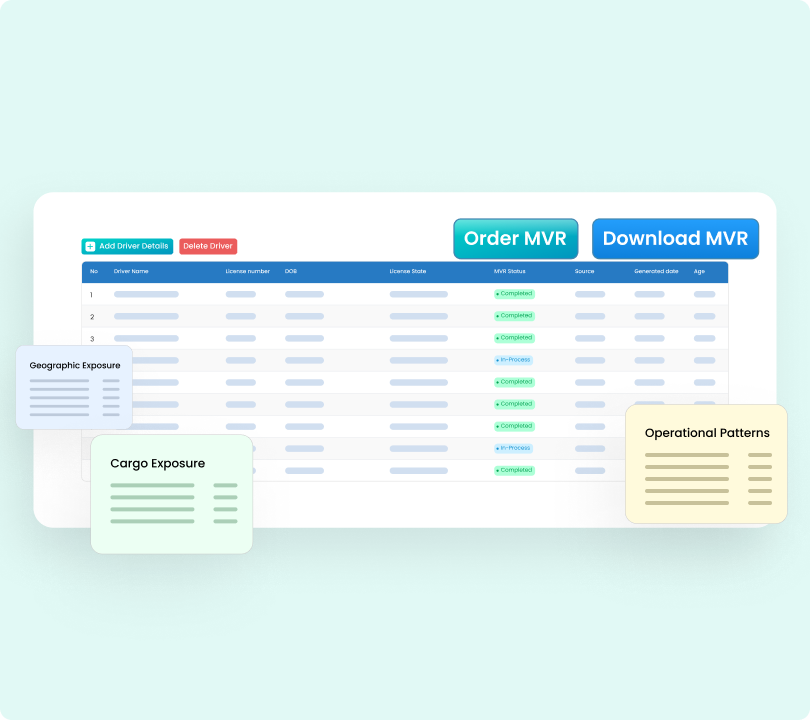

On-demand Report Ordering

Instantly order MVR and Loss Run reports with a robust, integrated feature set:

- Batch processing for multiple drivers or carriers in a single request.

- Real-time MVR retrieval through CogniSure partner API integration.

- Advanced error detection and handling during order workflows.

- Automated access to prior reports for seamless historical review.

- Structured and standardized data export compatible with downstream systems.

- Self-service dashboard with full audit trail and detailed order tracking.

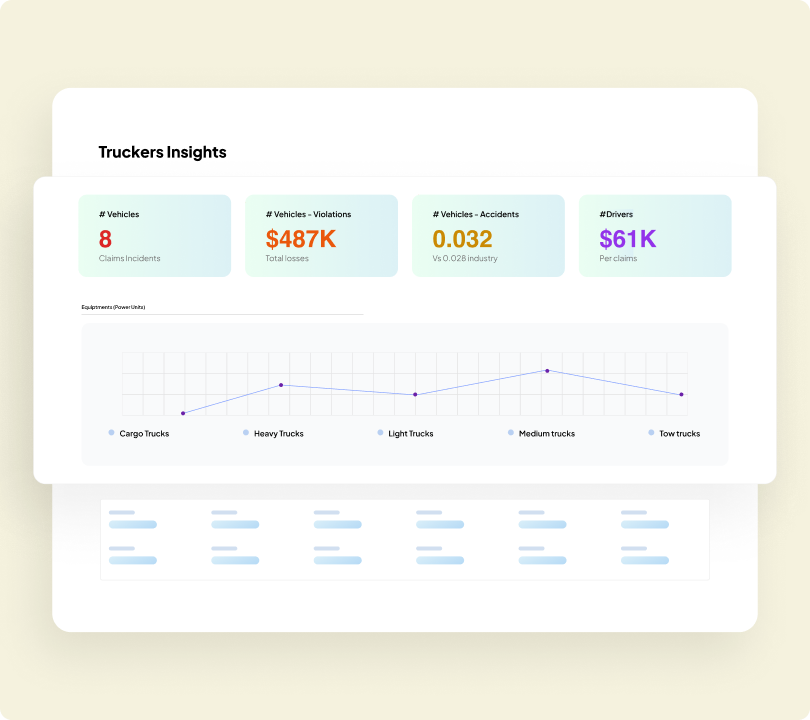

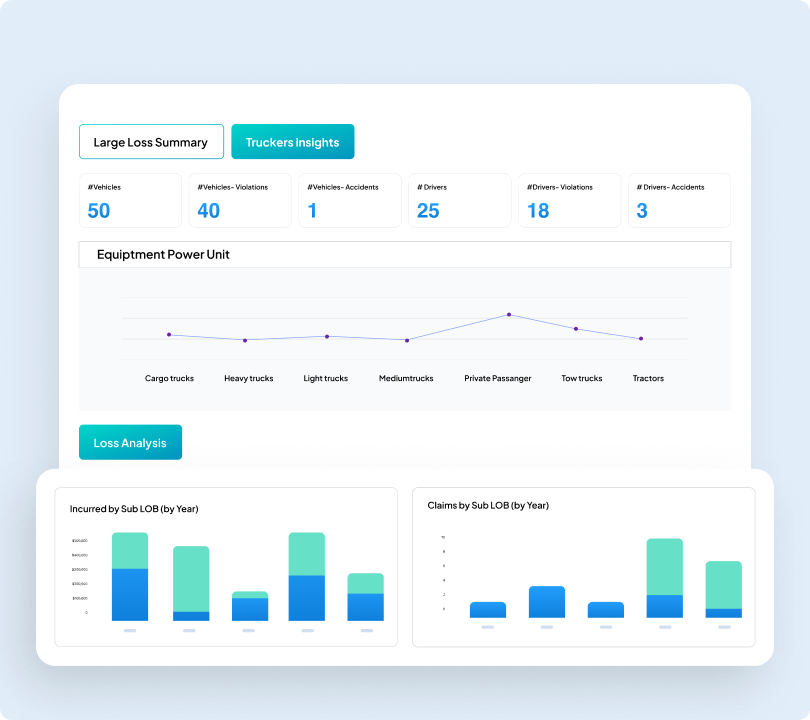

Truckers Risk Insight

Automates complex trucking submissions, reducing turnaround from weeks to hours.

- Automatically structures and scores multi-year, multi-line losses across all coverages.

- Compares IFTA, telematics, CAB, MVR, and schedules in real time.

- Analyzes financials, loss trends, and severity to save manual effort.

- Replaces complex Excel models with a unified, intelligent automation platform.

- Eliminates manual work, enabling focus on strategy and client relationships.

Program Package Designer

Automated Program Design Packaging streamlines and elevates the process of constructing comprehensive program proposals for brokers:

- Narrative highlighting risk profile and loss summary.

- Analytical view of driver and vehicle profile.

- Detailed coverage specification and limits.

- Comprehensive loss history in organized formats.

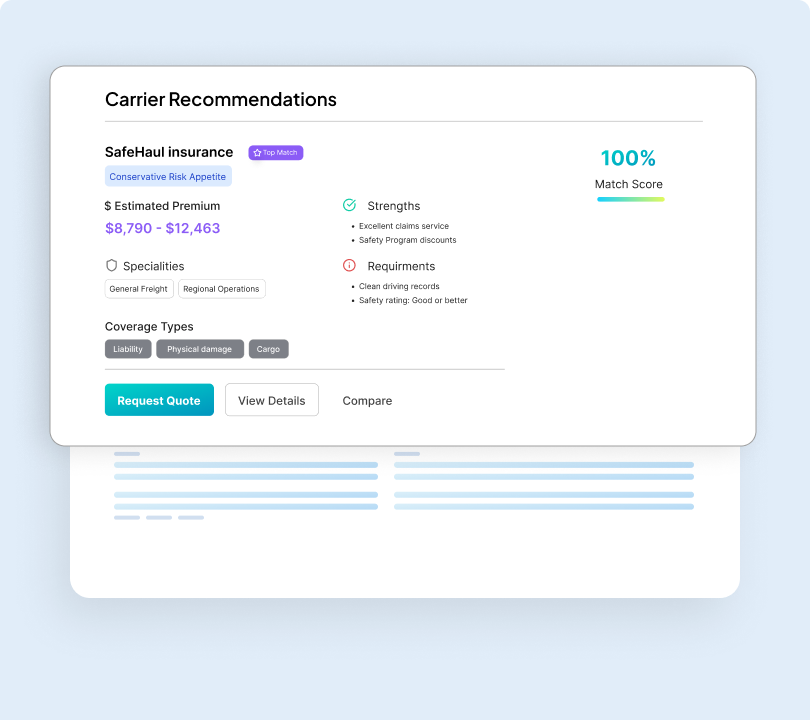

Multidimensional Matching to the Right Market

Matches each submission to ideal markets using real-time appetite intelligence.

- Recommends best-fit carriers using real-time appetite and submission data.

- Tracks carrier quoting, binding, declining behavior across market segments.

- Assesses underwriting fit by analyzing risk across multiple dimensions.

- Updates appetite rules based on submission trends and bind outcomes.

Digital Submission

Streamlines how brokers send applications to insurance carriers - by API, Bot (Carrier portal) and email:

- API: Instantly transmit submission data to carriers through automated, secure, real-time integration.

- Email: Generate carrier-specific application forms and send proposal documents directly to carrier inboxes.

- Bot (Carrier Portal): Automatically prefill and submit carrier portal through smart bots, eliminating data entry.

- Comprehensive tracking of all communications, documents, status updates, and quote responses-with full auditability.

- Centralized dashboard provides a real-time view of progress, outstanding tasks, and submission outcomes.

Ask PECO

Your intelligent trucking insurance assistant for faster reviews and smarter decisions.

- Instantly answers trucking submission and fleet portfolio questions.

- Flags missing data, mismatched records, or safety risk red flags in real time.

- Suggests follow-up questions using DOT, CAB, and loss run insights.

- Acts as your AI co-pilot for triaging complex trucking quotes.

- Continuously learns from past submissions, claims history, and market shifts.

- Guides new underwriters with quick access to carrier rules and industry data.

From Processing to Precision: Transforming Underwriting with Speed and Strategy

0%

Faster Quoting

0%

Error Reduction

0%

Processing Time

"Our submission management process for Trucking insurance was a highly complex and cumbersome process. CogniSure's solution has not only simplified it but also completely transformed it. What once took weeks now takes just a day or so, allowing us to respond faster to our customers and win more business. Our quote-to-bind ratio is up, we are able to handle growth without extra staff and our trucking clients get on the road with coverage sooner. It's been a true game-changer!"

Vice President (Transportation) - Top 10 Broker.