Advanced AI for Construction Insurance

Simplified Construction Risk

Effortlessly evaluate complex project risks with intelligent extraction and organization of exposure data from intricate submissions.

Simplified Construction Risk

Effortlessly evaluate complex project risks with intelligent extraction and organization of exposure data from intricate submissions.

Scalable Underwriting Operations

Support underwriting teams handling multiple projects simultaneously, optimizing resource allocation and workload distribution.

Scalable Underwriting Operations

Support underwriting teams handling multiple projects simultaneously, optimizing resource allocation and workload distribution.

Accelerated Time to Quote

Eliminate manual review bottlenecks with real-time, rules-based decisioning for faster, more accurate underwriting.

Accelerated Time to Quote

Eliminate manual review bottlenecks with real-time, rules-based decisioning for faster, more accurate underwriting.

Deliver Reliable Quotes

Generate insurance quotes that accurately reflect all project specifics, exposures, coverage options, and safety considerations.

Deliver Reliable Quotes

Generate insurance quotes that accurately reflect all project specifics, exposures, coverage options, and safety considerations.

Experience automated risk analysis, instant document extraction, and seamless workflow integration to streamline every step of the underwriting process.

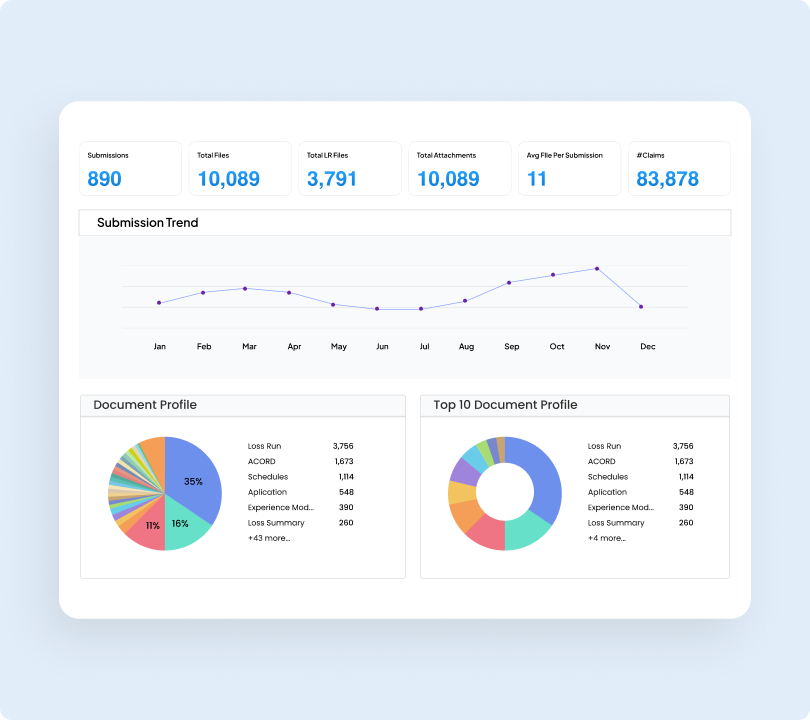

Construction Document Intelligence

Harness AI-driven document intelligence to automatically extract, validate, and organize critical construction insurance documents such as application forms, contracts, site surveys, and loss histories. Instantly transform unstructured project and insurance data into searchable, actionable insights for precise risk assessment and rapid underwriting decisions-minimizing manual effort and reducing errors in complex submissions.

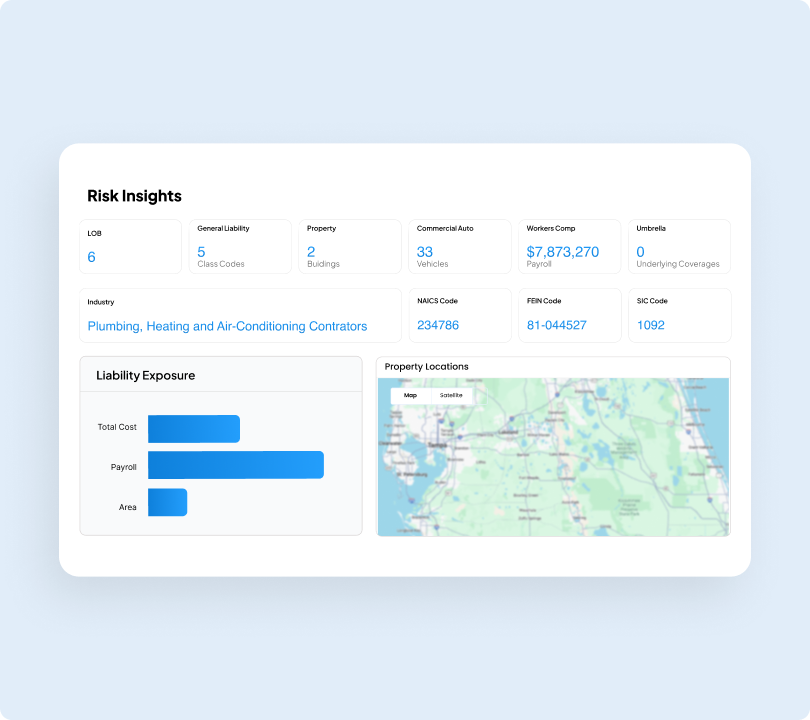

Multi-line Construction Coverage

Empower underwriting teams to seamlessly manage and assess a wide spectrum of construction risks-including builders risk, liability, professional indemnity, equipment, bonds, and more-all within one unified platform. Accelerate decision-making and ensure holistic protection by streamlining complex coverage combinations for diverse projects and stakeholders.

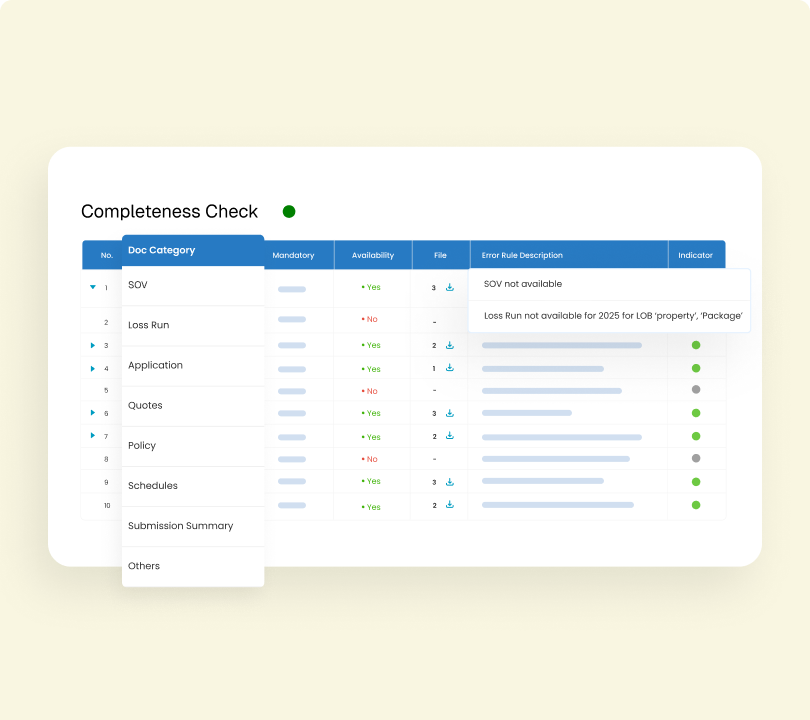

Automated Eligibility Check

Instantly evaluate every construction submission against carrier underwriting rules, required coverage, and compliance mandates-before an underwriter ever reviews it. AI-driven validation screens for missing documents, contract terms, site eligibility, and key exclusions, ensuring only qualified projects proceed to quoting and reducing turnaround times.

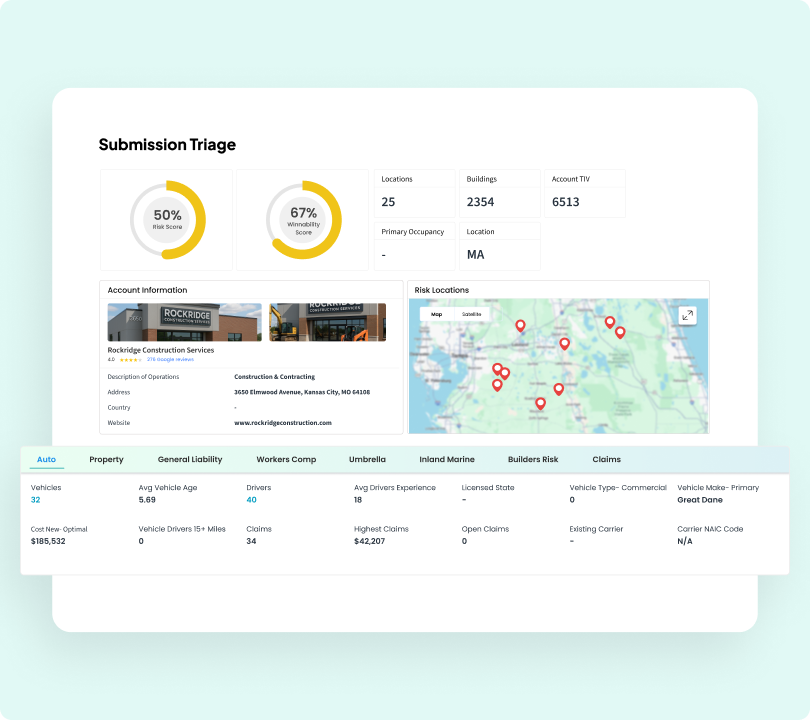

Construction Risk Intelligence

Gain deep visibility into project-specific risks using automated analytics that evaluate contractor performance, site hazards, safety practices and financial exposures. Leverage predictive data models to identify risk hotspots and support mitigation strategies for underwriters - boosting project outcomes and reducing costly surprises.

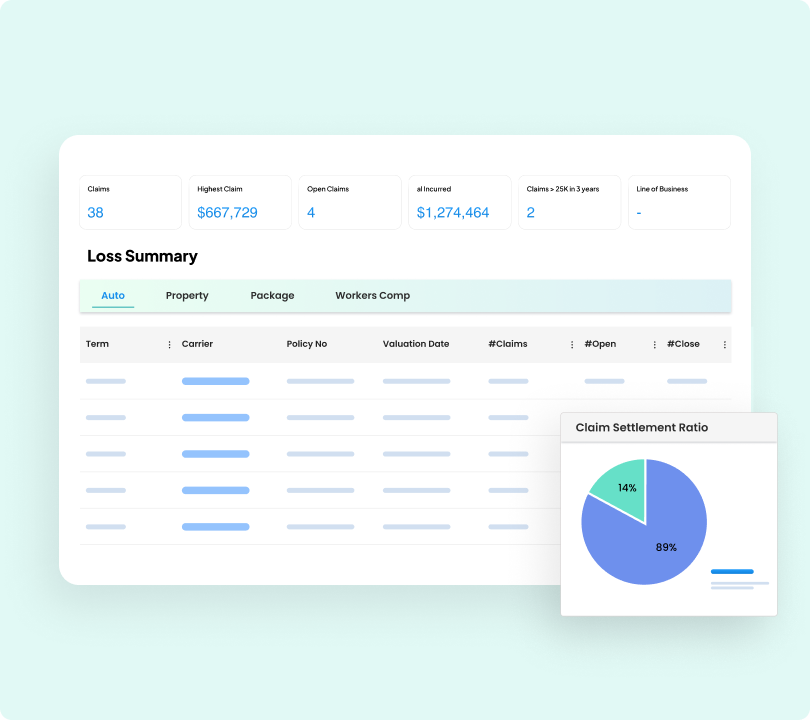

Predictive Claims Insight

Unlock actionable claims intelligence with advanced analytics that examine historical loss data, incident trends, and settlement outcomes-tailored for construction insurance. Empower underwriting and claims teams to spot emerging risks, detect potential fraud, set accurate reserves, and optimize claims management for lower costs and faster resolutions across diverse construction projects.