One Platform, Complete Risk Intelligence

Speed to Quote Advantage

Generate accurate quotes in minutes, not days-giving your partners and clients a faster, more competitive response every time.

Speed to Quote Advantage

Generate accurate quotes in minutes, not days-giving your partners and clients a faster, more competitive response every time.

Unified Multi-line Capability

Seamlessly manage submissions across lines such as auto, property, workers compensation, umbrella, general liability, and specialty products- all on a single, integrated platform.

Unified Multi-line Capability

Seamlessly manage submissions across lines such as auto, property, workers compensation, umbrella, general liability, and specialty products- all on a single, integrated platform.

Boost Underwriting Capacity

Effortlessly scale underwriting capacity to accommodate any surge in submission volumes - without increasing staff or sacrificing quality. No opportunities missed.

Boost Underwriting Capacity

Effortlessly scale underwriting capacity to accommodate any surge in submission volumes - without increasing staff or sacrificing quality. No opportunities missed.

Elevate Operational Efficiency

Reduce manual workload and eliminate repetitive tasks with intelligent automation and unified workflows.

Elevate Operational Efficiency

Reduce manual workload and eliminate repetitive tasks with intelligent automation and unified workflows.

Comprehensive AI-powered tools designed specifically for construction Six powerful capabilities designed to streamline your underwriting workflow, enhance decision-making, and accelerate time-to-quote for complex commercial submissions. insurance professionals

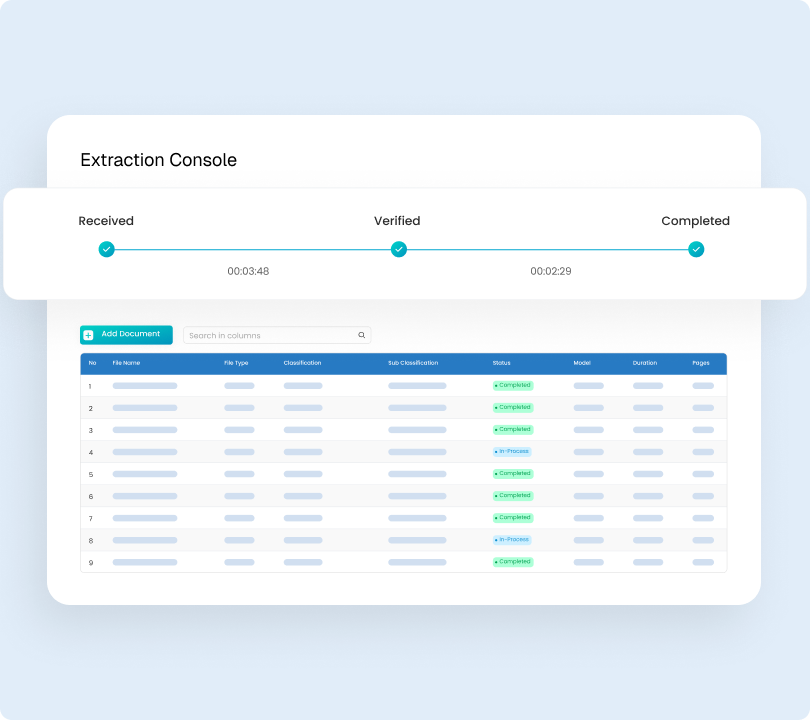

AI-Powered Document Processing

AI extracts and classifies insurance data, reducing manual work and speeding decisions.

- Processes ACORD forms, loss runs, and SOV schedules with 94% accuracy.

- Reduces manual data entry by 85% through intelligent OCR and NLP.

- Automatically classifies and routes documents to appropriate workflows.

- Extracts key data points including limits, deductibles, and exposure values.

- Real-time validation against business rules and data quality standards.

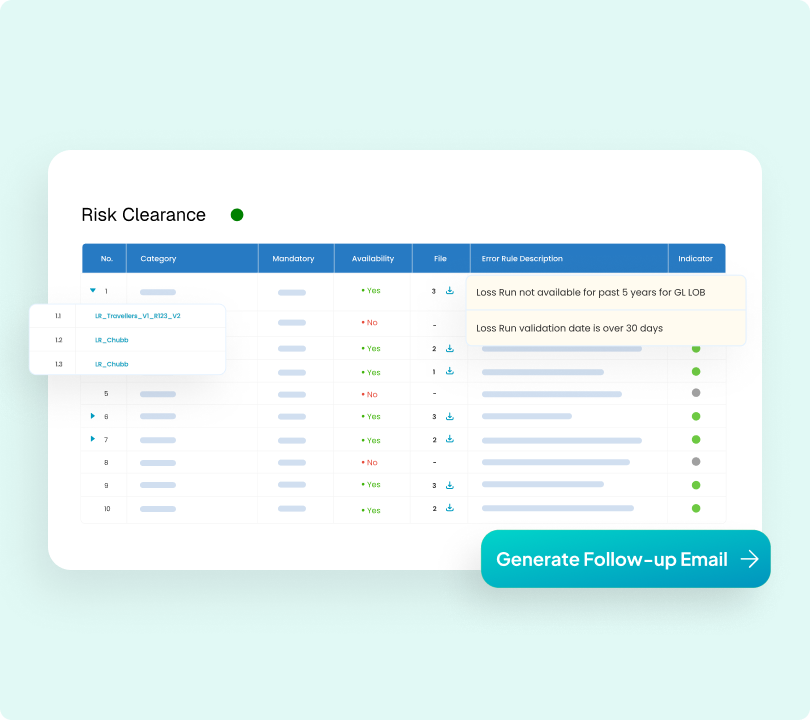

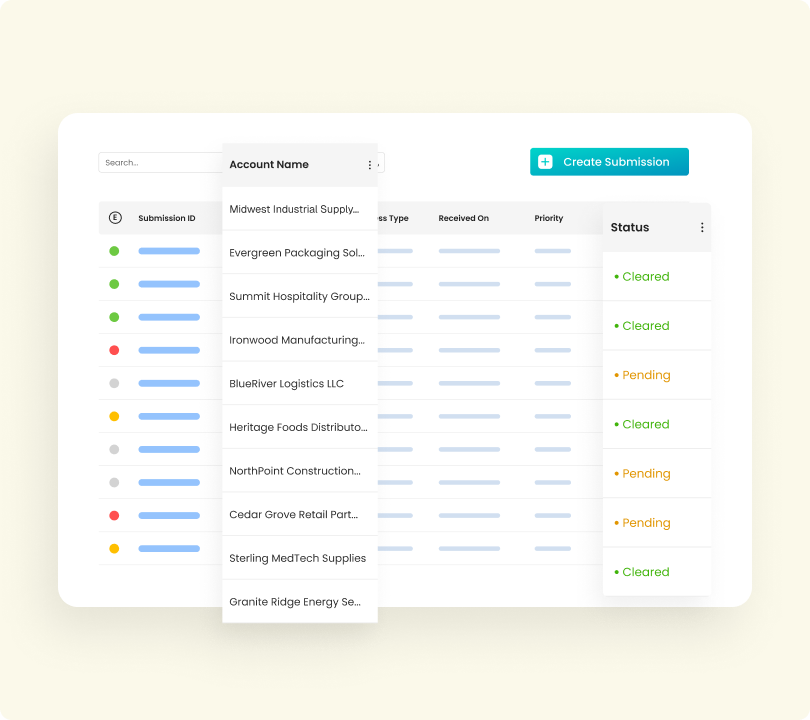

Risk Clearance & Completeness Verification

Real-time checks ensure complete, accurate submissions before underwriting begins, streamlining reviews.

- Real-time validation of required documents and data completeness.

- Automated identification of missing forms, signatures, and attachments.

- Business rules engine flags inconsistencies across multiple documents.

- Color-coded completeness indicators for instant status visibility.

- Configurable checklists based on line of business and coverage types.

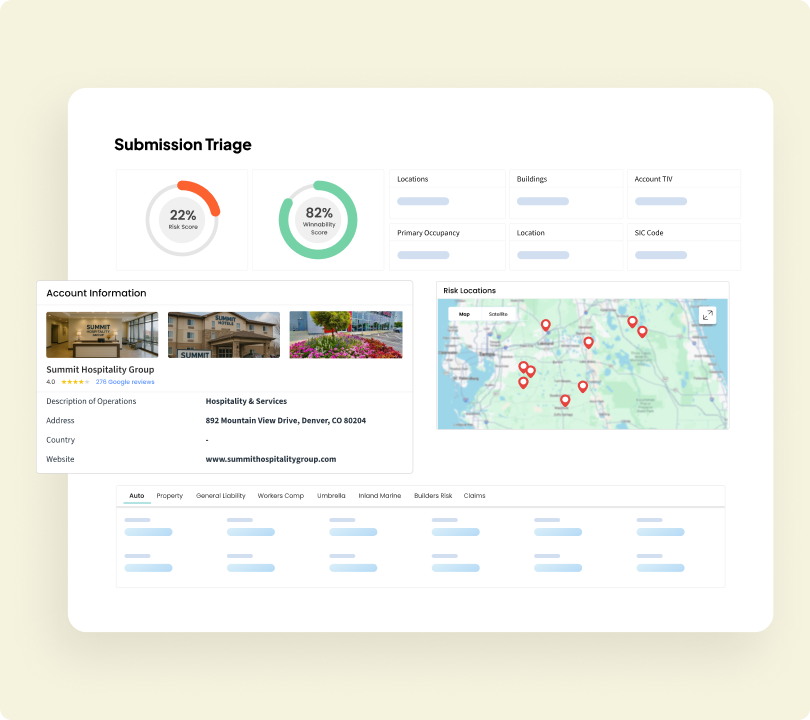

Prioritized Submission Triage

Smart submission triage by risk and value with color-coded statuses and routing.

- Automated prioritization based on Risk score and Winnability score.

- Color-coded status indicators for instant workflow visibility.

- SLA tracking and escalation alerts for time-sensitive submissions.

- Customizable priority rules aligned with business objectives.

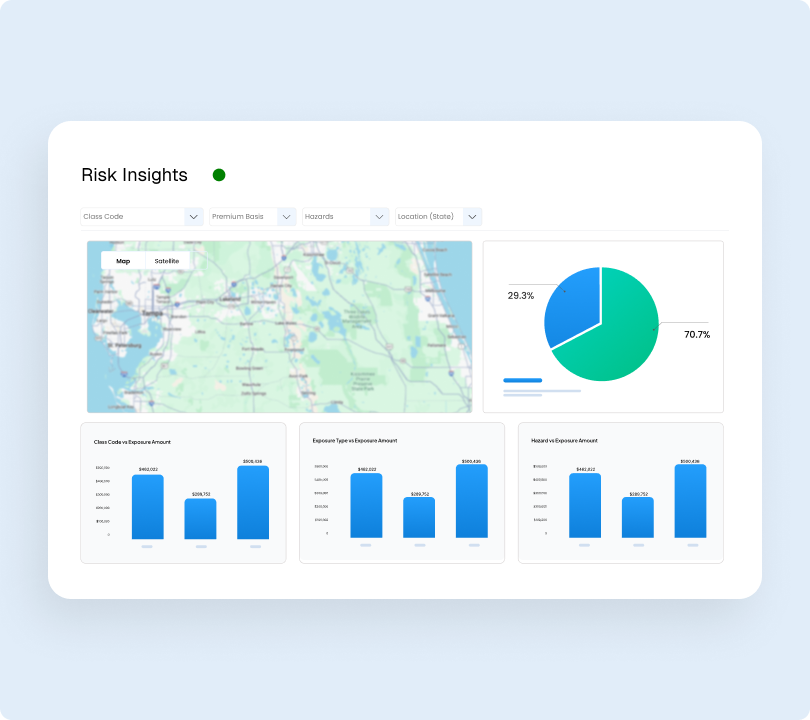

Comprehensive S360 Data Integration

Unified 360° view blends internal data with third-party sources for better risk decisions.

- Integrates 15+ third-party data sources including HazardHub and OSHA.

- Real-time geocoding and address standardization for accurate location data.

- NAICS code prediction and SIC classification for industry risk assessment.

- Historical weather patterns and catastrophe modeling integration.

- Unified dashboard presenting internal and external data in single view.

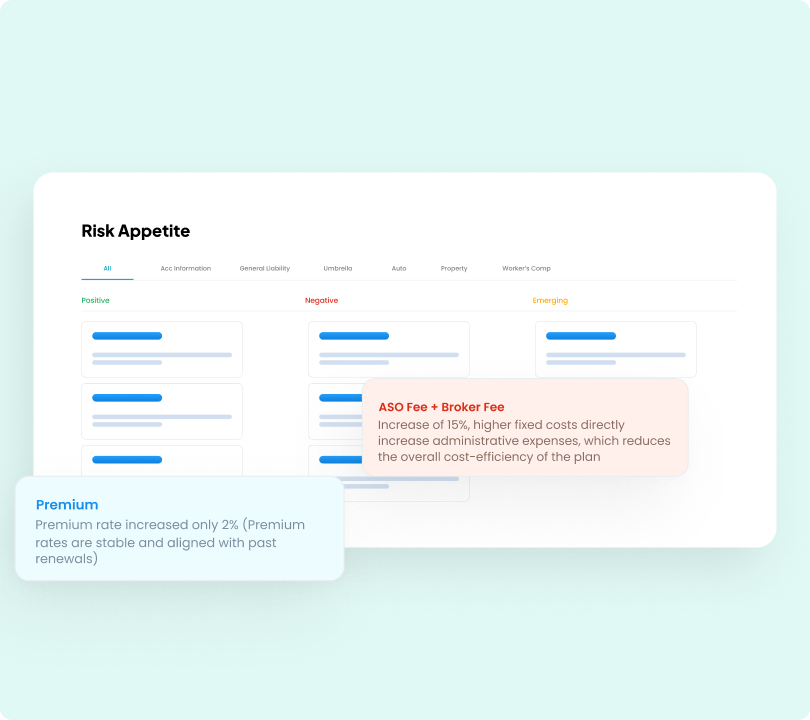

Risk & Winnability Scoring Dashboard

Advanced dashboard delivers risk scores, claims insights, and winnability for smarter underwriting.

- Proprietary risk scoring algorithms incorporating 200+ risk factors.

- Winnability assessment based on historical pricing and competitor analysis.

- Interactive heat maps showing geographic and industry concentration.

- Claims frequency and severity trending with predictive analytics.

- Customizable dashboards with drill-down capabilities for detailed analysis.

Centralized Inbox & Communication Hub

Central hub for submission communication with alerts, tasks, and progress tracking.

- Unified inbox consolidating emails, documents, and internal communications.

- Automated task assignments and follow-up reminders based on workflow stage.

- Real-time collaboration tools for underwriter and broker interactions.

- Audit trail tracking all communications and decision points.

- Mobile-responsive design enabling remote access and quick responses.

Sean Murray

Managing partner, Mutual Underwriters

We are thrilled to see how CogniSure AI can convert hard-to-digest, large commercial submission documents consisting of ACORD Applications, SOV schedules, and Loss Runs received from brokers into structured data that we can consume in our e-commerce platform and rating system, allowing us to save significant costs, efforts, and make better risk decisions.