Key Benefits

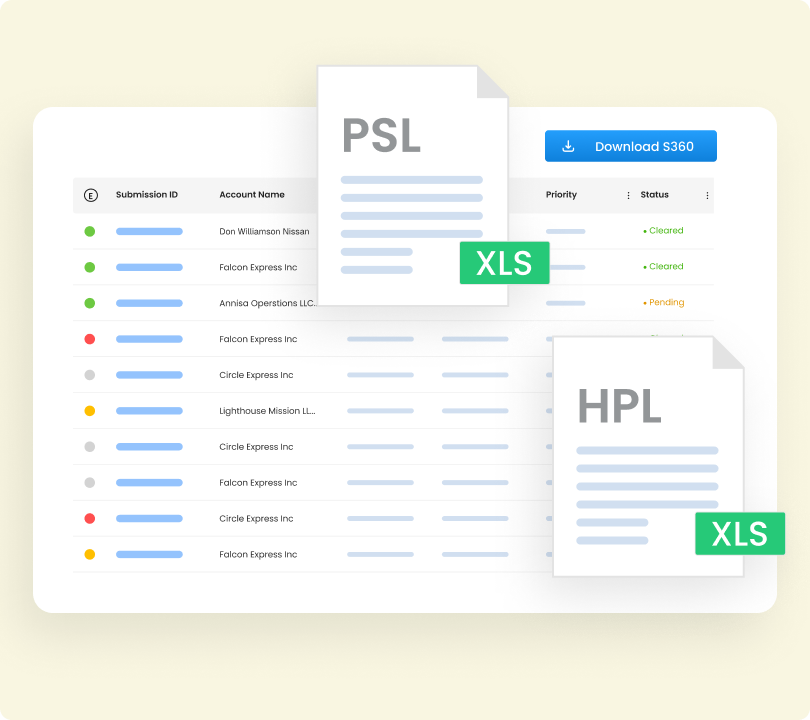

On-demand Rating Models (HPL / PSL)

Smart digital intake workflow for HPL and PSL enabling one-click generation of rating models.

On-demand Rating Models (HPL / PSL)

Smart digital intake workflow for HPL and PSL enabling one-click generation of rating models.

Precision Medical Risk Underwriting

Advanced analytics score risks across patient acuity, specialties, historical claims, and regulatory compliance.

Precision Medical Risk Underwriting

Advanced analytics score risks across patient acuity, specialties, historical claims, and regulatory compliance.

Seamless Underwriting Flow

Integrated flow through the quote lifecycle enabling unified underwriting experience.

Seamless Underwriting Flow

Integrated flow through the quote lifecycle enabling unified underwriting experience.

Effortless Scalability

Easily manage growing volumes of submissions without adding operational overheads.

Effortless Scalability

Easily manage growing volumes of submissions without adding operational overheads.

Transform how Medical malpractice Underwriters evaluate, and manage malpractice risk.

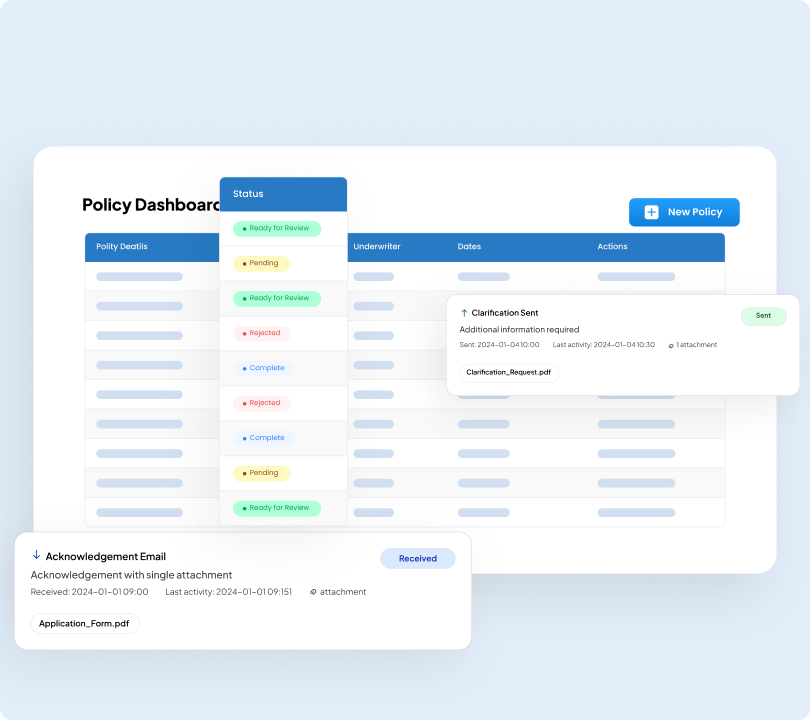

AI-Powered Submission Management

Track, triage, and manage every submission with intelligent automation.

- Track full submission lifecycle from intake to bind.

- Automated submission triaging and risk clearance workflows.

- Built-in risk appetite scoring and submission prioritization.

- Integrated document viewer for quick assessment and annotations.

- Auto-notifications for pending quotes and bottlenecks.

NPI & Third-Party Data Integrations

Auto-validate and standardize physician data with trusted external sources.

- Instantly validate physician identities using live NPI registry integration.

- Auto-populate exposure schedules with accurate, clean data.

- Align specialty descriptions and exposure codes using ISO standards.

- Reduce duplication and manual cleanup of provider data.

- Smart suggestions for missing or mismatched Physician data.

Multi-Model Rating Configuration

Support PSL, HPL, and custom models with flexible rating logic.

- Configure rating logic for PSL, HPL, and hybrid models.

- Support for RVU-, visit-, hour-, or encounter-based calculations.

- Set rules by specialty, state, limit/deductible levels, and retro dates.

- Easy-to-update model library for underwriters or actuaries.

Dr. PECO (AI Agent)

Your intelligent assistant for faster reviews and smarter decisions.

- Instantly answers submission-specific or portfolio-level questions.

- Flags missing fields, inconsistencies, or risk anomalies in real time.

- Recommends follow-up questions or rating assumptions.

- Acts as an AI co-pilot during triaging and quoting.

- Continuously learns from past submissions and team preferences.

- Assists new underwriters with context and knowledge retrieval.

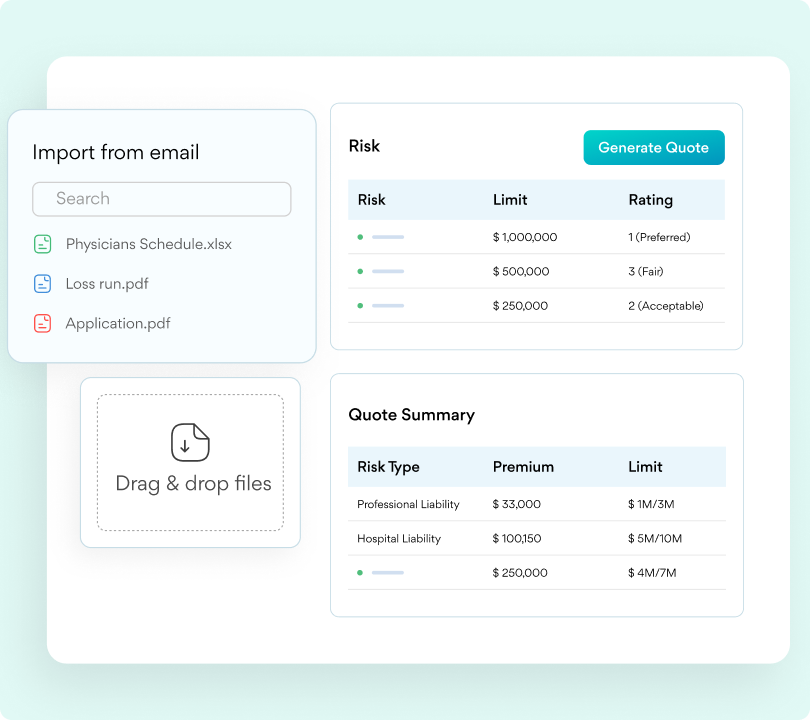

Seamless Workflow Integration & Rule-Based, Error-Free Ratings

Ensure consistency and eliminate manual errors across your workflow.

- Connects with inboxes, portals, or admin systems without disrupting workflow.

- Imports documents directly from email or drag-and-drop portal.

- Auto-executes rating logic based on pre-set underwriting rules.

- Removes manual variability and reduces rate discrepancies.

- Generates rating models and quote summaries with one click.

- Supports API integration for seamless quote-to-bind flow.

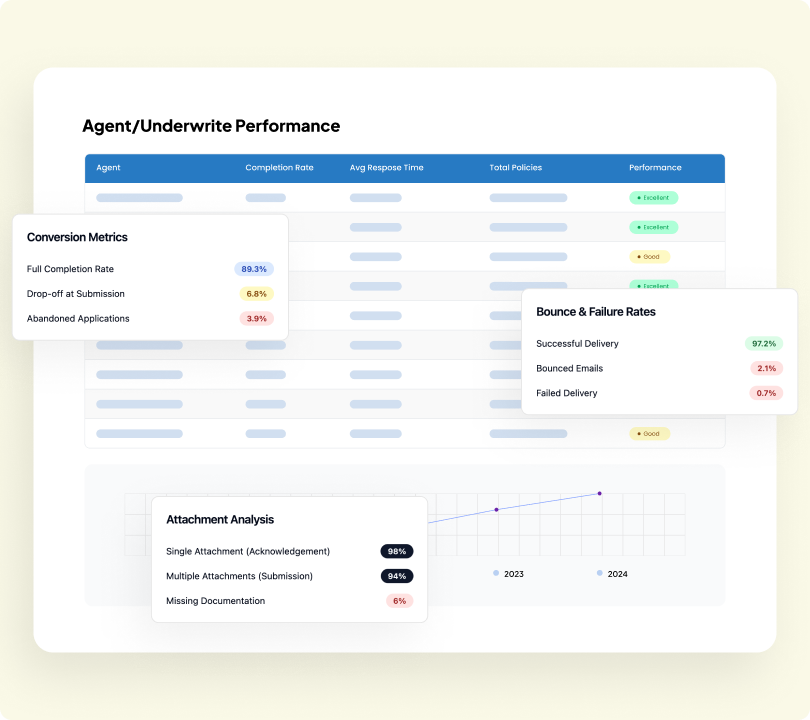

Benchmarking Insights on Portfolio Performance

Track quote-to-bind metrics and underwriting performance with precision.

- Bind ratios and loss trends by broker, agency, and geography.

- Underwriter-level productivity, accuracy, and turnaround metrics.

- Track average lag days and bottlenecks across the pipeline.

- Monitor hit ratios, quote aging, and quote-to-bind conversions.

- Visual dashboards with trend indicators and filters.

- Export-ready reports for leadership and actuarial teams.

Cutting Quote Turnaround Time by 60% for a Regional Medical Malpractice Carrier

0%

Faster Quoting

0%

Error Reduction

<0 Min

Processing Time

A regional medical malpractice insurance carrier automated and standardized its submission-to-quote process leveraging CogniSure's Medical 360 Submission platform. Previously slowed by manual data entry, inconsistent rating applications, and compliance risks, the carrier faced delays of over eight business days and declining broker trust. Using AI-powered data extraction, third-party validation, rule-based rating, and a centralized portal with real-time tracking and anomaly detection, the solution streamlined workflows, improved accuracy, reduced errors, and freed underwriters to focus on decision-making, ultimately enhancing efficiency and broker responsiveness.