Everything You Need for Smarter Benefits Management

25+ Data Source Types Supported

Seamlessly ingest data from carriers, TPAs, PBMs, and stop-loss providers-no matter the format or source.

25+ Data Source Types Supported

Seamlessly ingest data from carriers, TPAs, PBMs, and stop-loss providers-no matter the format or source.

10+ Claims Report Types Supported

Handles medical, pharmacy, high claims, IBNR, stop-loss, and rebate files-despite inconsistent formats, missing fields, or complex data structures.

10+ Claims Report Types Supported

Handles medical, pharmacy, high claims, IBNR, stop-loss, and rebate files-despite inconsistent formats, missing fields, or complex data structures.

20+ Rate & Fee Report Types

Processes plan designs, eligibility files, fee schedules, and more-even when buried in unstructured PDFs or messy spreadsheets.

20+ Rate & Fee Report Types

Processes plan designs, eligibility files, fee schedules, and more-even when buried in unstructured PDFs or messy spreadsheets.

Third-Party Data Sources Integrated

Connects with carrier portals, PBM feeds, stop-loss systems, and public Rx databases-plus planned integrations with care gap programs.

Third-Party Data Sources Integrated

Connects with carrier portals, PBM feeds, stop-loss systems, and public Rx databases-plus planned integrations with care gap programs.

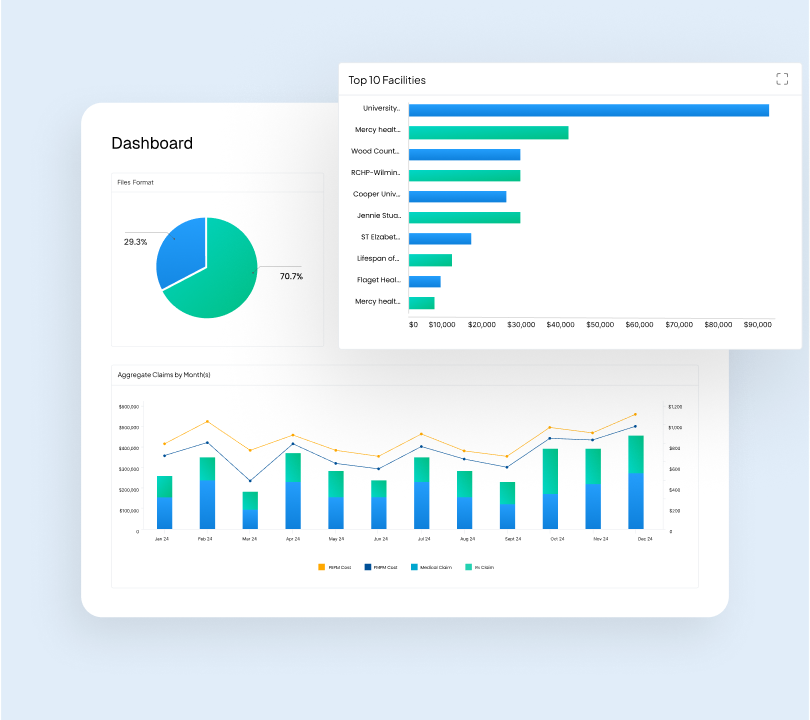

From brokers to HR teams, everyone benefits from unified financial insights.

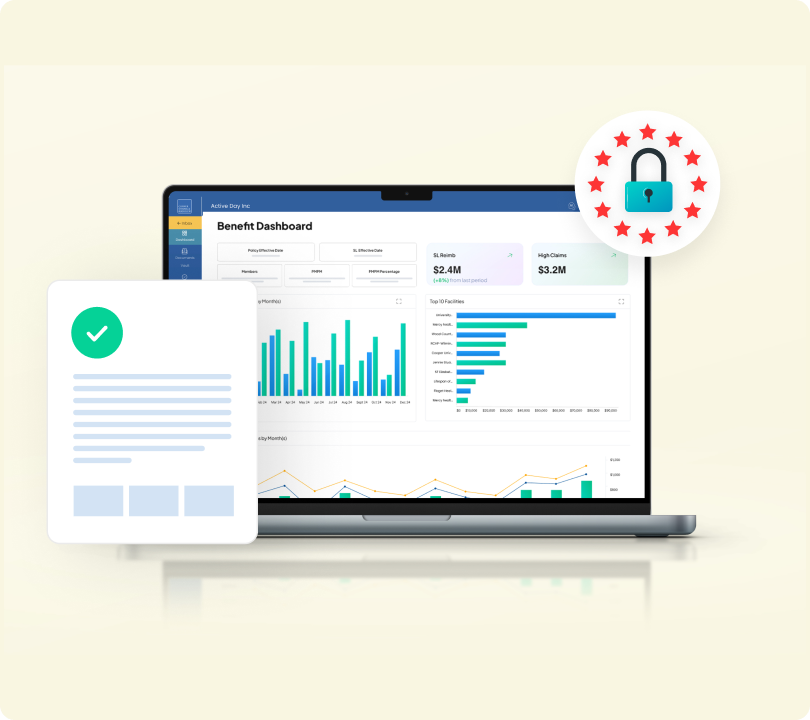

Standardized Financial Reporting Package

Turn complex carrier data into clean, ready-to-use employer reports.

- Consolidates data from 25+ carriers and TPAs into employer-ready templates.

- Enables one-click generation of white-labelled reports.

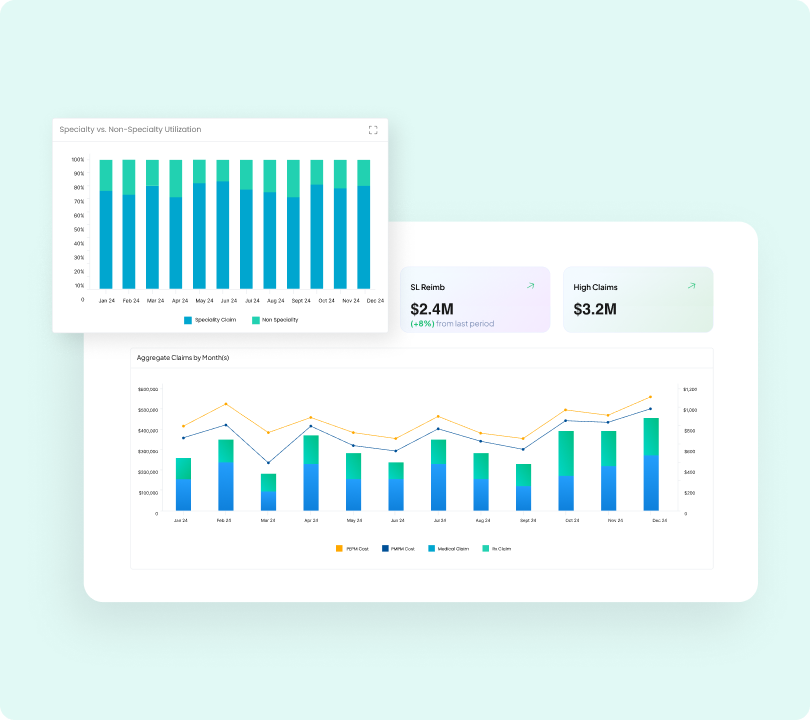

Claims Analysis & Surplus/Deficit Insights

Spot overspending, track trends, and surface cost drivers instantly.

- Flags benefit overspends or surplus by month, trend, or plan type.

- Identifies high-cost claimants and utilization spikes.

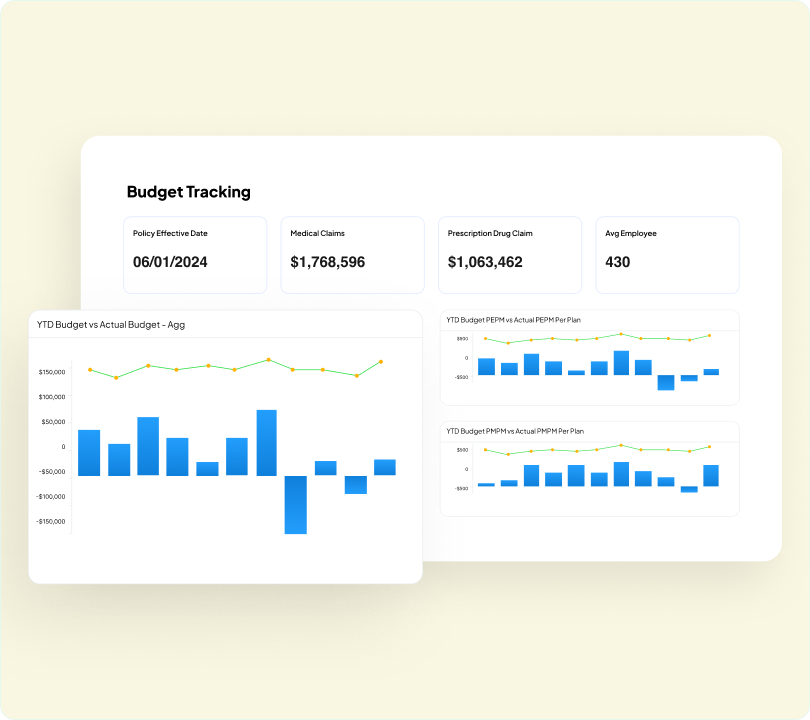

Budget Reconciliation & Stop-Loss Monitoring

Keep claims aligned with budget and avoid stop-loss surprises.

- Tracks actual claims vs. budgeted spend.

- Sends alerts when nearing stop-loss thresholds.

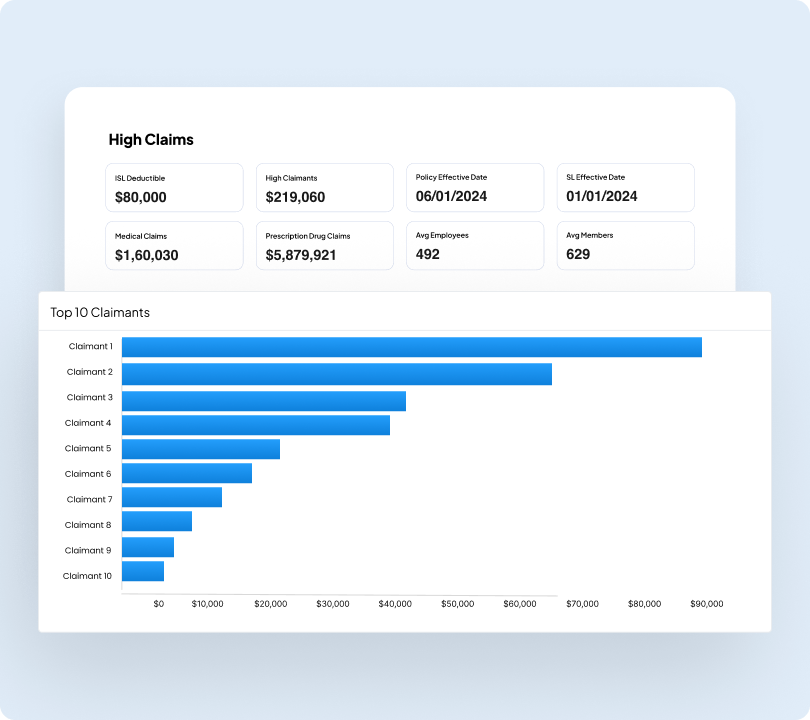

Member Behaviour & High Claimant Analysis

Understand member patterns to flag risk and control volatility.

- Visualizes behaviour changes and high-risk profiles.

- Tracks enrollment volatility and cost anomalies.

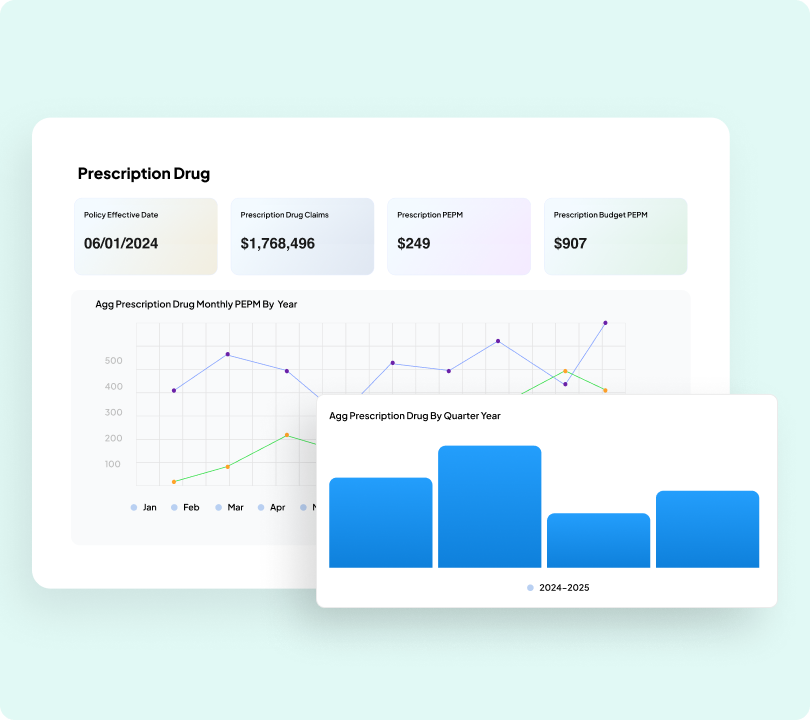

Pharmacy Cost & Utilization Breakdown

Decode the rising Rx spend and optimize plan design proactively.

- Highlights key drivers of rising Rx costs.

- Supports formulary decisions and plan optimization.

HIPAA-Compliant & Secure Infrastructure

Protect every data point with enterprise-grade security and compliance.

- Full encryption and compliance with PHI/HIPAA standards.

- Role-based access and audit trail features for underwriting workflows.

Joe DiBella

EVP - Conner Strong & Buckelew

For self-funded employers, benefit plan claim reporting remains a major pain point. Data evaluation takes hundreds of hours of manual manipulation to harmonize reams of desperate reports. Thankfully, CogniSure AI has revolutionized this archaic process with their new Benefit insights solution. Their platform systematically merges data from multiple vendors across multiple lines to help clients implement strategies to bend cost curve.