Streamline Property Submission - The Intelligent Way

Unified Property Intelligence

Automated extraction of data from ACORD, SOVs/schedules, loss runs etc, and enrich with geocoding, hazard details, and valuation insights.

Unified Property Intelligence

Automated extraction of data from ACORD, SOVs/schedules, loss runs etc, and enrich with geocoding, hazard details, and valuation insights.

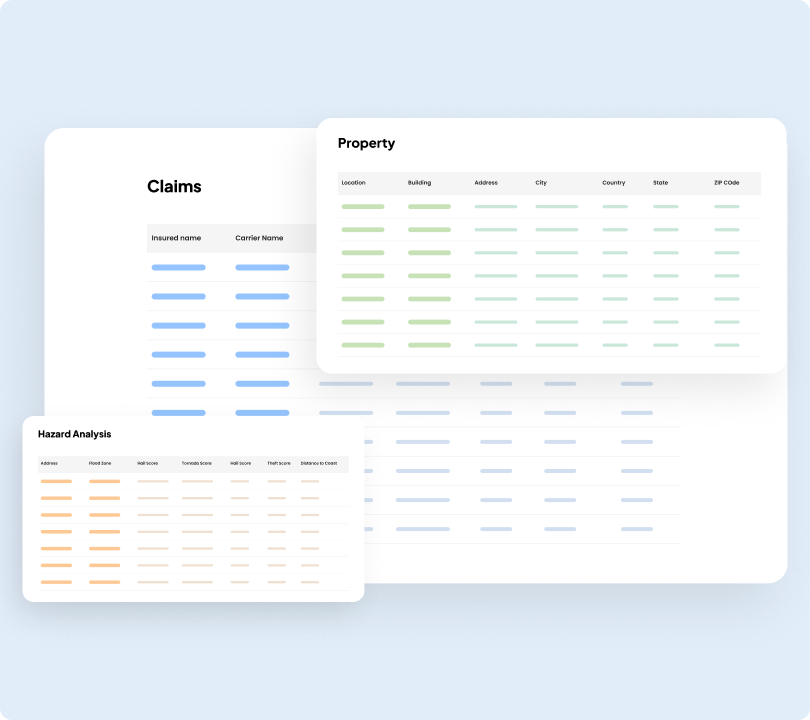

Automated Schedule Analysis

Free your team from spreadsheet fatigue and transform schedules and SOVs into organized schedule data by location, occupancy and risk types.

Automated Schedule Analysis

Free your team from spreadsheet fatigue and transform schedules and SOVs into organized schedule data by location, occupancy and risk types.

Instant Risk Appetite Screening

Automatically screen property submissions against insurer risk appetite, location, occupancy, and eligibility rules.

Instant Risk Appetite Screening

Automatically screen property submissions against insurer risk appetite, location, occupancy, and eligibility rules.

Smarter Risk & Faster Decisions

Use property data, loss history, and catastrophe analytics to assess risk, automate intake, and deliver faster compliant submissions.

Smarter Risk & Faster Decisions

Use property data, loss history, and catastrophe analytics to assess risk, automate intake, and deliver faster compliant submissions.

AI-powered tools to evaluate property characteristics, catastrophe exposure, and loss history compliance, enabling precise risk assessment. Streamline underwriting with real-time insights for faster, more accurate policy decisions.

360° Property Risk

Gain a holistic view of property exposures, hazards, and historical losses for smarter, data-driven risk assessment and underwriting

- Efficiently extract critical data from Emails, SOVs, ACORD 125/140, loss runs, property surveys, and all supporting attachments.

- Automatically check for missing fields, inconsistencies, and duplicates to guarantee data accuracy.

- Integrate external sources, such as hazard databases, flood reports, and property valuation tools, for a complete risk profile.

- Intelligent, Underwriter-centric categorization into Account profile, Property exposure, and Loss history for easy review and analytics.

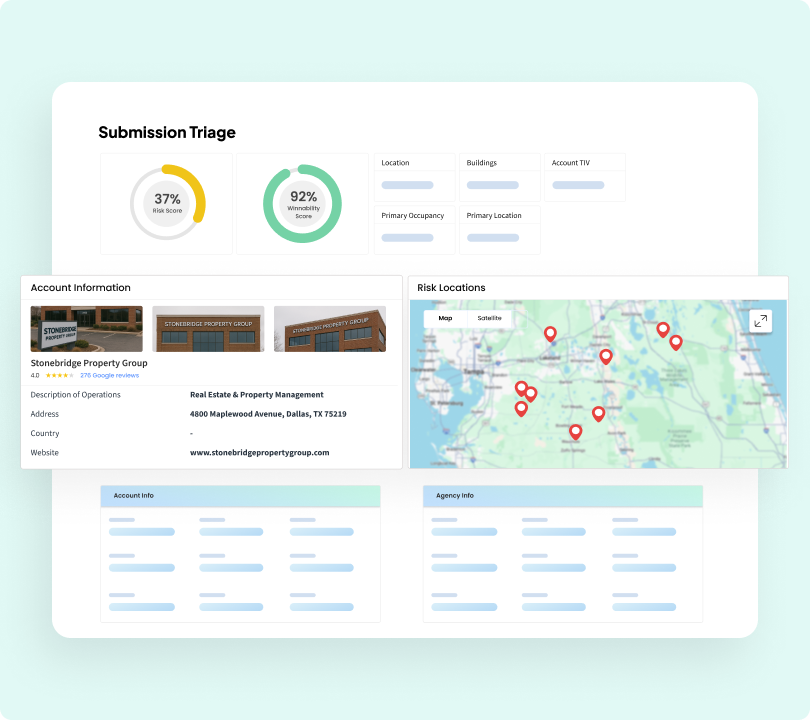

Prioritized Submission Triage

Smart routing and prioritization to focus on winnable property deals.

- Automated property scoring with risk indicators, color-coded statuses, and SLA tracking.

- Configurable rules align with appetite, business goals, and underwriting objectives.

- Document-aware triage prioritizes catastrophe exposure, recent loss runs, property valuations.

- Third-party enrichment with Hazard Analysis: catastrophe modeling, geocoding, prohibited class detection, and property characteristic validation.

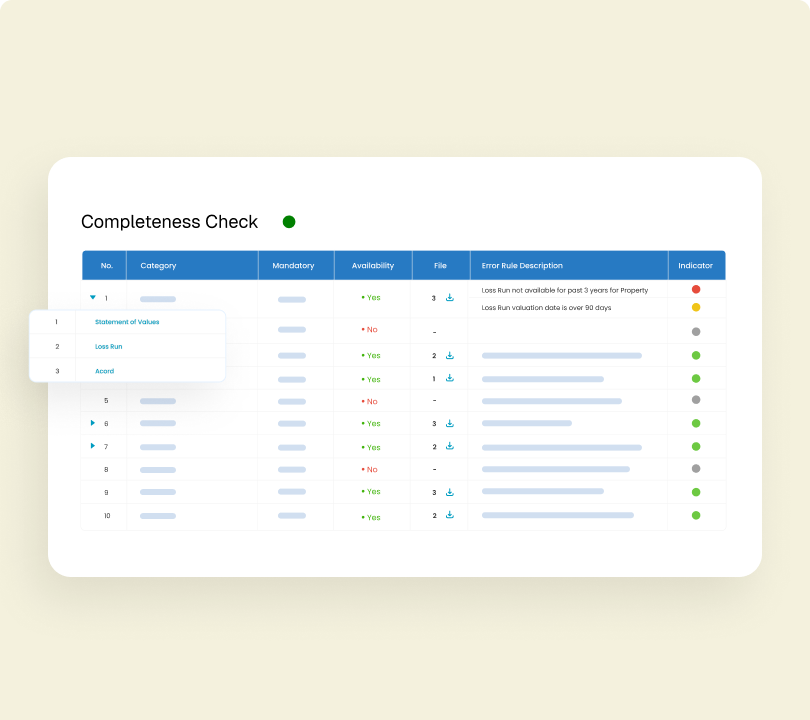

Risk Clearance & Completeness Verification

Real-time checks ensure accurate and complete property submissions before underwriting.

- Required property docs vary by state: includes ACORD 140, SOV schedules, loss runs, inspection reports.

- Validates property valuation accuracy, catastrophe model effective dates, and cross-document property/coverage/location reconciliations.

- Flags missing/invalid building class codes, maps catastrophe zones, verifies inspection signatures, compliance forms.

- Automates catastrophe data retrieval, connects to modeling bureaus for exposure validation and audit links.

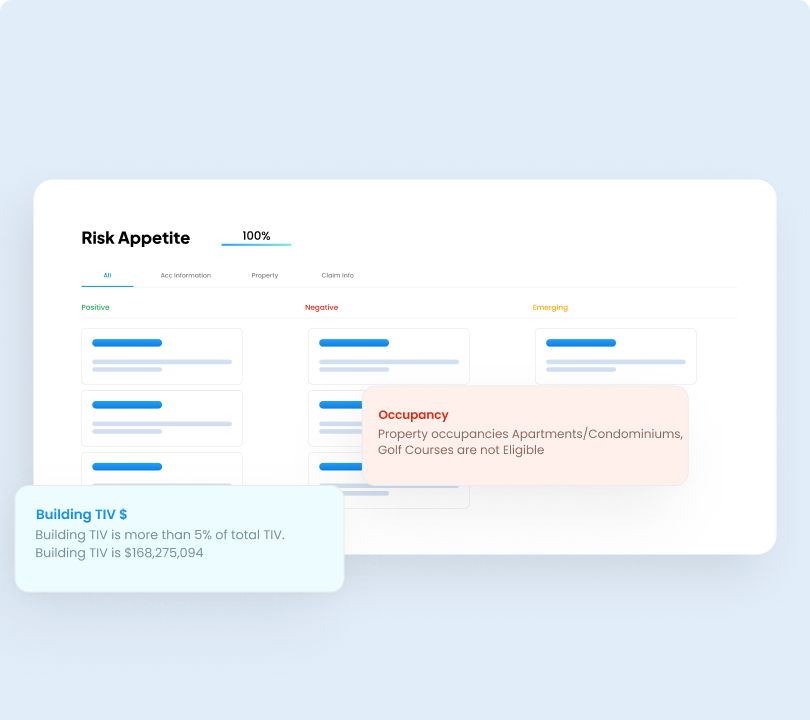

Risk Appetite & Winnability

Clear appetite fit assessments tailored for Property Insurance.

- Appetite matrices by building class families with state-specific catastrophe exposure thresholds.

- Supports regional/jurisdiction nuances, out-of-appetite limits, and multi-location underwriting rules.

- Benchmarks against peer cohorts, historical performance, and verified property modeling values.

- Integrates catastrophe severity/frequency data and prohibited building class rules into appetite scoring.

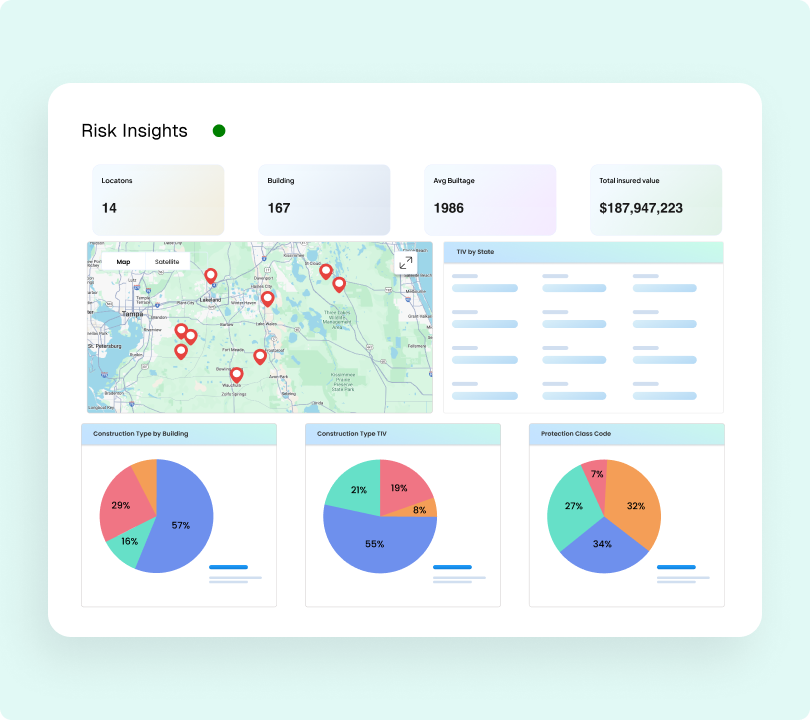

Risk Insights for Property

Operational and actuarial analytics designed for property underwriting.

- Tracks loss trends, claim frequency, catastrophe development, closure rates, and jurisdictional differences.

- Analyzes property valuation volatility, building class shifts, and projects prospective catastrophe scenarios.

- Combines completeness, catastrophe signals, and loss analytics into underwriting readiness scoring.

- Benchmarks catastrophe exposure trajectory by region, overlaying weather pattern data and enforcement actions.