Untangle the Chaos of Loss Runs

Scanned Input

Extracts structured data from scanned PDFs, faxes, and handwritten notes effortlessly.

Scanned Input

Extracts structured data from scanned PDFs, faxes, and handwritten notes effortlessly.

Merged Reports

Automatically separates loss runs by carrier, line, and policy period.

Merged Reports

Automatically separates loss runs by carrier, line, and policy period.

Spreadsheet Parsing

Handles multi-tab, merged-cell files to extract structured claim data.

Spreadsheet Parsing

Handles multi-tab, merged-cell files to extract structured claim data.

Nested Tables

Captures sub-tables and hierarchy to preserve contextual claim details.

Nested Tables

Captures sub-tables and hierarchy to preserve contextual claim details.

Format Agnostic

Adapts instantly to any carrier layout, terminology, or template.

Format Agnostic

Adapts instantly to any carrier layout, terminology, or template.

Intelligent Prediction

Fills missing fields using policy context and claim history.

Intelligent Prediction

Fills missing fields using policy context and claim history.

Stamp Removal

Ignores 'Confidential' or watermark stamps to extract claim data.

Stamp Removal

Ignores 'Confidential' or watermark stamps to extract claim data.

Handwritten Notes

Accurately reads scribbled or low-resolution handwritten notes.

Handwritten Notes

Accurately reads scribbled or low-resolution handwritten notes.

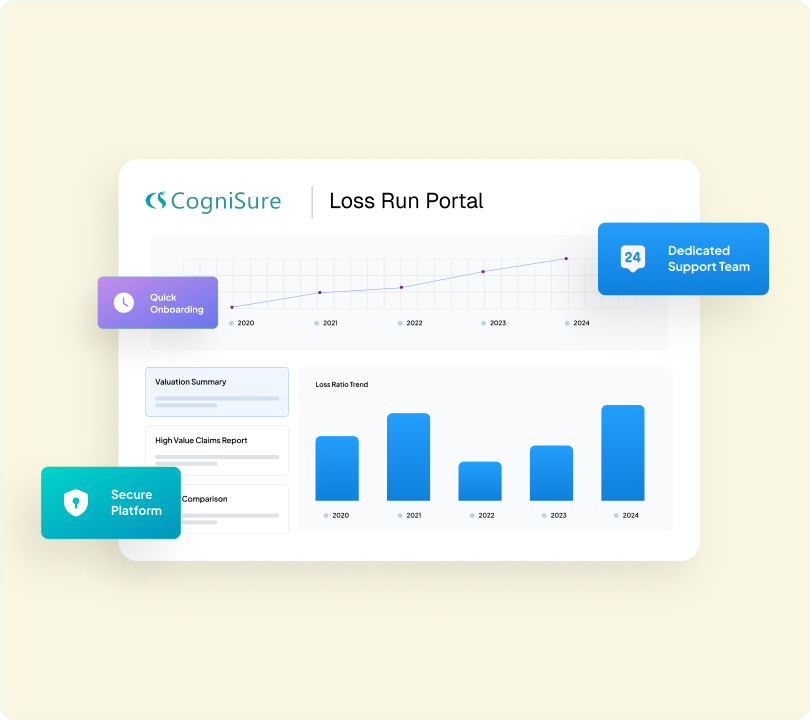

Effortlessly view, manage, and analyse your entire loss run portfolio with our intelligent, end-to-end platform-purpose-built for today’s insurance professionals. Gain instant insights, streamline workflows, and make faster, smarter underwriting decisions.

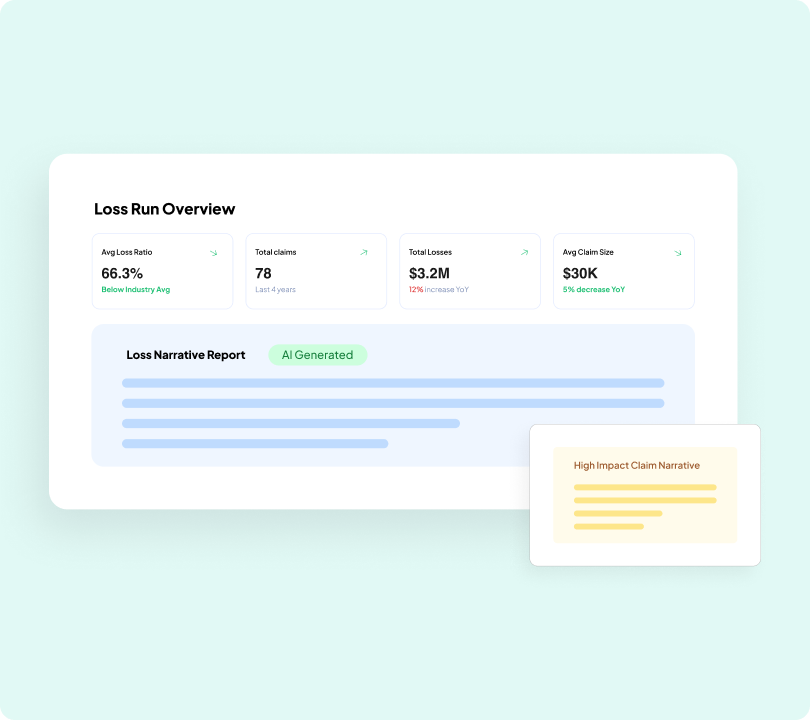

Actionable Loss Intelligence

Cut through the clutter of raw loss runs. Our platform extracts, analyzes, and presents structured insights like:

- Loss frequency vs. severity trends.

- High-risk claim categories (e.g., AL vs. APD).

- Flagged outliers in reserves or paid amounts.

- Year-over-year performance summaries.

No more manual review of messy PDFs. Get instant clarity to assess risk profiles with confidence.

AI-Powered Loss Run Narrative

Every underwriter needs a story-not just numbers. Our system generates automated loss summaries in under 30 seconds:

- “The insured experienced consistent auto liability losses in 2022 and 2023, primarily in Texas and Illinois, with severity spikes in Q4 2023. Claims indicate a pattern of rear-end collisions involving commercial drivers.”

You get narratives tailored to each account, ready to copy into underwriting notes.

Risk Mitigation Insights

Don’t just understand the past-help insureds prevent future losses. We highlight:

- Repeat incident locations or vehicles.

- Policy lapses leading to uncovered losses.

- Risk-prone behavior like distracted driving or theft.

Use these insights to recommend targeted loss control strategies and drive value-added underwriting.

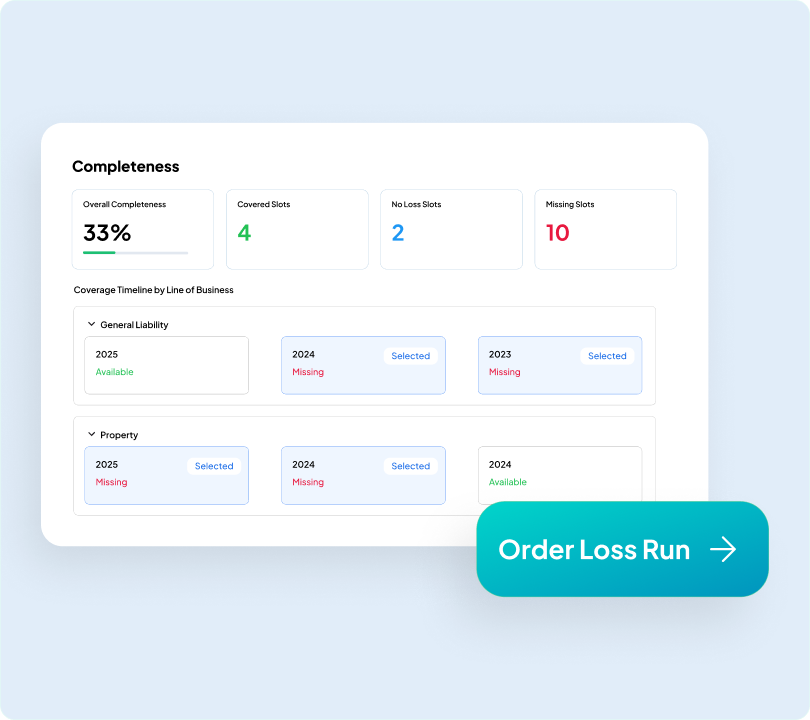

Streamlined Loss Run Ordering

Say goodbye to delays in data collection. Our platform.

- Automates loss run requests to multiple carriers.

- Follows up intelligently on missing or incomplete reports.

- Maintains a centralized loss run repository for each client.

Spend less time chasing documents and more time analyzing them.

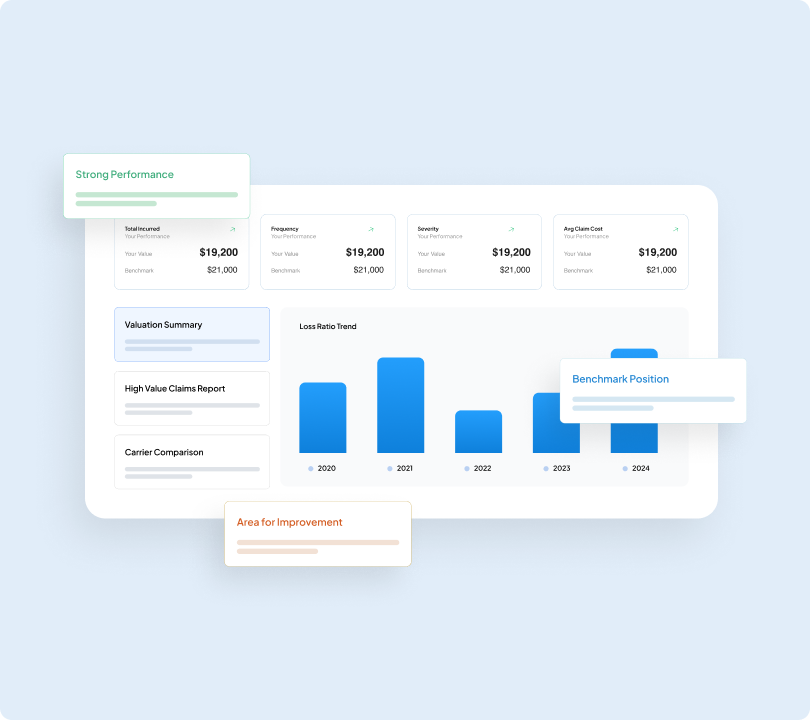

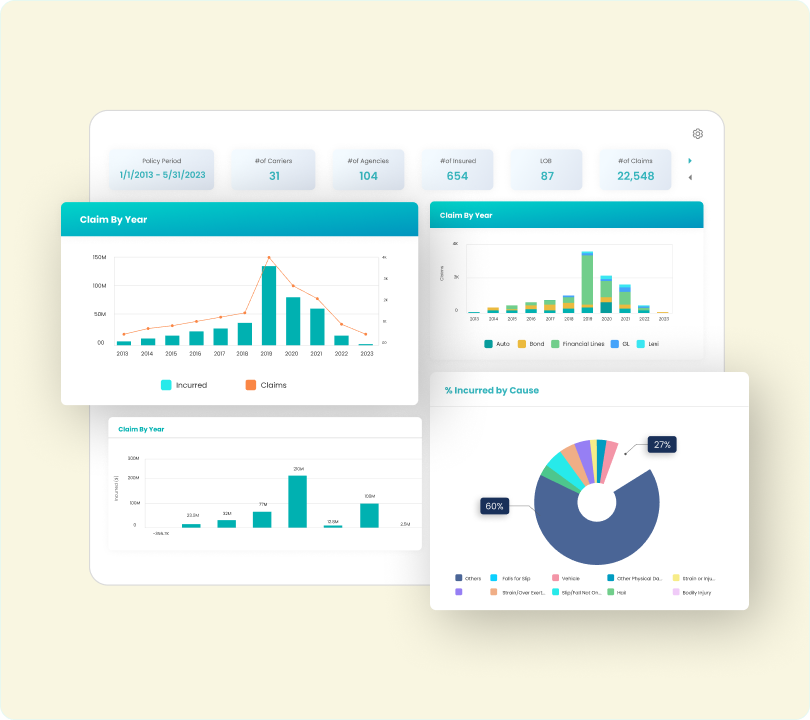

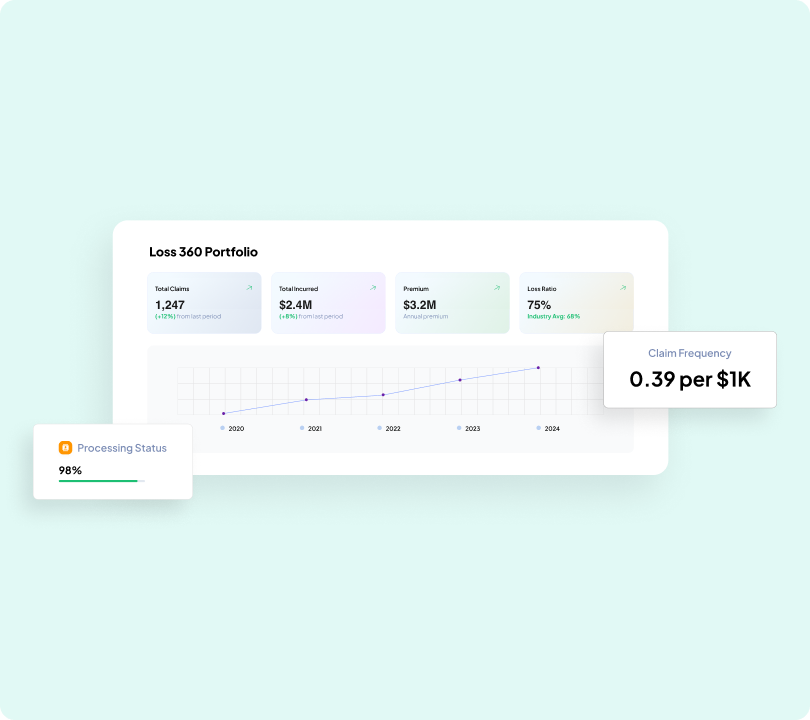

Portfolio Management

Gain a holistic view of your entire book of business.

- Track cumulative losses across accounts.

- Compare performance by segment, region, or industry.

- Identify accounts with emerging risk patterns.

Make data-driven decisions for renewals, repricing, and targeted outreach.

Turnkey Implementation

Get started in days, not months-with zero IT burden.

- Seamless integration with your existing systems.

- Secure, cloud-based access with role-based controls.

- Dedicated onboarding and support teams.

Get instant access to our Loss Run Portal via a secure Magic Link-no setup, no strings attached.

Murali Natarajan

Sr VP & CIO, West Bend Mutual Insurance

As part of our commercial underwriting transformation, we are excited to partner with CogniSure AI after evaluating their loss run insights solution through an extensive pilot. We are thrilled to see how CogniSure AI can convert hard-to-digest large commercial loss runs received from other carriers into underwriting summaries in minutes, allowing us to make better risk decisions.

Mike McIntire

CTO, Graham (MMC Company)

CogniSure's ability to quickly map and normalize loss data from multiple carriers is a game changer. In an industry with very little data standardization, CogniSure provides producers and account teams with the ability to deliver insights into customer loss information that was previously too difficult to make use of in an efficient manner.

Brett Tiagwad

VP - CONNER STRONG & BUCKELEW

Historically, collecting and analyzing data has been an important but challenging and time consuming process for our team members; often taking hours to prepare accurate loss run reports. CogniSure's platform will be an enormous improvement by easily and efficiently converting carrier data into well-organized summaries for clients.