End-to-end AI Powered Solution

CogniSure's GenAI-Powered Underwriting

Data-To-Decision Supply Chain

Revolutionizes insurance operations by orchestrating intelligent workflows, deploying adaptive AI agents, and ensuring uncompromised data integrity across the enterprise.

Schedule a Demo

Platform Overview

End-to-End Automation

Complete automation of the underwriting process from document intake to decision output, eliminating manual bottlenecks.

End-to-End Automation

Complete automation of the underwriting process from document intake to decision output, eliminating manual bottlenecks.

Flexible Architecture

Modular, API-first design that integrates seamlessly with existing systems and scales with your business needs.

Flexible Architecture

Modular, API-first design that integrates seamlessly with existing systems and scales with your business needs.

AI-Powered Extraction

Advanced GenAI models extract, validate, and structure data from any document format with human-level accuracy.

AI-Powered Extraction

Advanced GenAI models extract, validate, and structure data from any document format with human-level accuracy.

Scalable & Secure Data Layer

Enterprise-grade security and compliance with unlimited scalability to handle peak submission volumes.

Scalable & Secure Data Layer

Enterprise-grade security and compliance with unlimited scalability to handle peak submission volumes.

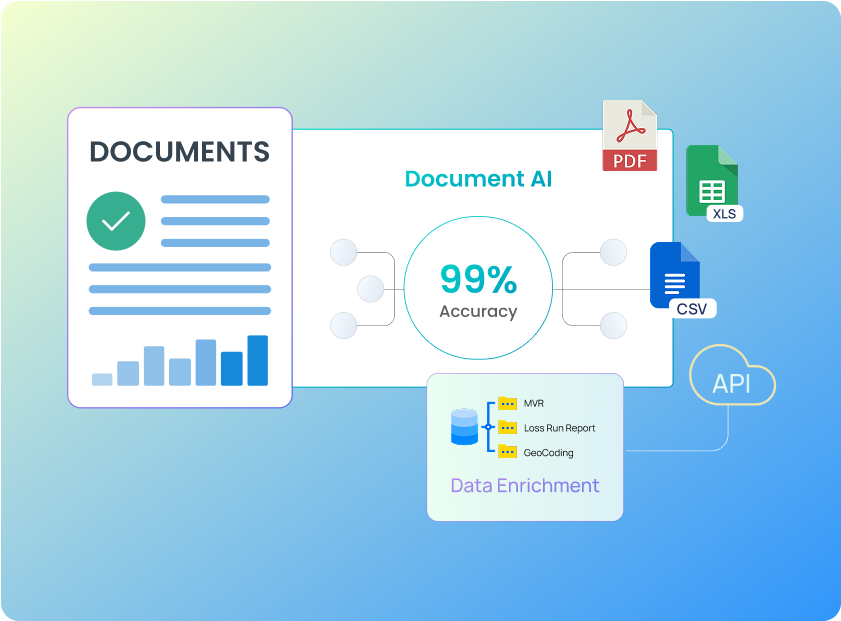

Better Data

Better Data

Achieve up to 99% accuracy with a hybrid engine of Document AI and LLMs-cutting manual fixes to near zero.

Leverage 90+ pre-trained extraction AI models purpose-built for insurance documents like SOVs, Loss Runs, Schedules, and Applications.

Unlock multi-format document intelligence with support for PDFs, Excels, CSVs, emails, and API ingestions from cloud and enterprise systems.

Ensure data trustworthiness through automated validation, deduplication, and external enrichment (MVR, DOT, Google Maps, etc.).

Store structured results in secure, scalable data lakes or warehouses, optimized for both analytics and real-time integration.

Product Configuration Studios

A no-code, AI-powered configuration studio suite that streamlines document intake, drives precise data extraction, and empowers underwriters with configurable risk logic - all in one seamless platform.

Extraction Studio

Prompt-Driven Smart Data Extraction

AI-Powered Prompt Configuration

Build and test custom prompts to extract key fields from any document type.

Category-Specific Extraction Profiles

Fine-tune extraction logic for Loss Runs, SOVs, and Certificates with field-level precision.

Flexible Prompt Managementt

Edit, version, and assign prompts dynamically - no redeployment needed

360 Studio

Configurable Business Rules Engine

Custom Document AI Rules Made Easy

Configure document‑specific intelligent extraction rules across PDFs, Excel, and more-no code required. Set up IDP rules per document type for PDFs and spreadsheets-zero coding needed.

Category-Aware Document Handling

Tailor configurations for Loss Runs, SOVs, and more, ensuring category-specific accuracy.

Validation & Lookups

Define validation and look up rules specifics to broker or carrier

Underwriting Studio

Risk Decision Logic Configuration Hub

Define Triage & Risk Rules

Configure custom logic to score, route, or flag submissions based on data attributes.

Automated Decision Frameworks

Set rule-based triggers to auto-assign, escalate, or prioritize underwriting actions.

No-Code Business Rule Engine

Empower underwriting teams to create, test, and manage rules - without IT involvement.

Portfolio360 View

Surface high-priority submissions, evaluate risk profiles, and make confident decisions with real-time insights across agencies, industries, and geographies-all in one dynamic dashboard.

Intelligent Triage Insights

Surface what matters. Instantly identify top-performing agencies, industries, and geographies - powered by dynamic triage summaries that help underwriters prioritize high-value submissions.

Agency-wise submission volume, industry breakdown, class code visibility.

Operational Visibility at a Glance

Control the flow. Real-time operational analytics reveal submission trends, document profiles, and channel-wise patterns - helping ops teams optimize throughput and detect bottlenecks early.

Track document types, intake channels, and volume spikes effortlessly.

Performance-Driven Decision Support

From data to action. Empower underwriters and managers with clear submission completion rates, location trends, and risk segmentation tools - all from a centralized dashboard.

Drive better triage, faster turnaround, and smarter resource allocation.